The economics of inequality

Post-Keynesian models of inequality and growth

Dr. Matthias Schnetzer

December 09, 2022

Recap

- What are the channels of income redistribution by the welfare state?

- What do the terms “progressive” and “regressive” with regard to the tax system mean?

- Which one has a stronger effect on redistribution in Austria? Taxation or transfers?

Macroeconomic implications of functional distribution

![]()

Distribution and growth

Two questions in Post-Keynesian economics:

- Which effect do real wage increases have on employment?

- Which effect does a shift in the functional distribution have on growth?

Labour market in economics

Neoclassical model of the labour market:

- Price (real wage) brings supply and demand into equilibrium

- LM = one market among many

- Effect of real wage increase on employment is negative

- Why? Wages are costs

Post-Keynesians:

- Labour market is downstream of production

- Production is determined by effective demand

- Effect of real wage increase on employment is positive

- Why? Wages are demand

Post-Keynesian growth models

4 generations of PK growth models:

- Keynes, Kalecki

- Robinson, Kaldor

- Bhaduri, Marglin, Dutt, Taylor

- Barbosa, Rada, Rezai, Hein, Onaran, Stockhammer

| Full employment | Unemployment | |

|---|---|---|

| Full capacity utilization | Kaldor (v.1) | Robinson |

| Excess capacity | - | Kalecki |

The wage-led/profit-led debate

![]()

General framework

- Post-Keynesian growth model: Investment and savings function depend on distribution (neither savings nor technological progress determine growth)

- Aggregate output equals wages and profits (\(r\) = profit rate) \[ pX = wN + prK \]

- \(\delta\) is the wage share and \(\pi\) is the profit share \[ \delta = \frac{wN}{pX} \\ \pi = \frac{prK}{pX} = \frac{rK}{X} \]

Determination of profit rate

Let \(X_{fe}\) be potential output, \(l\) labour/output ratio, \(v\) capital/output ratio (= technology, assumed constant: \(v=1\)) and \(u\) capacity utilization \[ l=\frac{N}{X}; v=\frac{K}{X_{fe}}; u=\frac{X}{X_{fe}} \] \[ p=w\frac{N}{X} + rp \frac{K}{X}; \frac{K}{X} = \frac{v}{u}; v=1; \] \[ p = wl + rpu^{−1} \rightarrow \pi = \frac{rp}{up} = \frac{r}{u} \rightarrow r= \pi u \]

Profit rate \(r\) depends on profit share \(\pi\) and capacity utilization \(u\)

Recall partial derivatives

\[ y = \frac{u(x)}{v(x)} \]

\[ y' = \frac{u'(x) \cdot v(x) - v'(x) \cdot u(x)}{v^2(x)} \]

First generation: Kaldor-Robinson

- Assumption: Workers do not save, full capacity utilization (\(u=1\))

- Growth rate of investments consists of growth of autonomous investments \(g_0\) and the elasticity to the profit rate \(\alpha r\) \[ g_I = g_0 + \alpha r \]

- Savings come only out of profits (Cambridge equation: Pasinetti, 1962) with \(s\) as saving propensity of capitalists \[ g_S = sr \]

- In equilibrium \(g_S = g_I\) and thus \[ sr = g_0 + \alpha r \\ r^∗= \frac{g_0}{(s − \alpha)} \]

- How does the profit rate react to saving? \[ \frac{\partial r^*}{\partial s} = − \frac{g_0}{(s−\alpha)^2} <0 \]

- The equilibrium growth rate with \(r^*\) is \[ g^∗ = g_0 + \alpha r^* = g_0 + \alpha \frac{g_0}{s− \alpha} = \frac{sg_0}{s−\alpha} \]

- How does the growth rate react to saving? \[ \frac{\partial g^*}{\partial s} = \frac{g_0(s−\alpha)−sg_0}{(s−\alpha)^2} = −\frac{\alpha g_0}{(s−\alpha)^2} <0 \]

- Higher propensity to save reduces growth and profitability due to lower aggregate demand.

Second generation: Neo-Kaleckians

- Capacity utilization now endogenous (relax assumption of \(u=1\)); a high capacity utilization leads firms to invest more to satisfy expected demand \[ g_I = g_0 + \alpha r + \beta u \]

- In equilibrium \(g_I = g_S = sr\) and since \(r = u \pi\) \[ su\pi = g_0 + \alpha u \pi + \beta u \\ u^* = \frac{g_0}{\pi(s−\alpha)−\beta} \\ \frac{\partial u^*}{\partial \pi} = −\frac{(s-\alpha)g_0}{\left[ \pi (s−\alpha)− \beta\right]^2} <0 \]

- A rising profit share reduces aggregate demand (lower consumption propensity of capitalists) and thus capacity utilization

- The profit rate falls with rising profit share: \[ r^* = \pi u^* = \frac{\pi g_0}{\pi (s−\alpha)−\beta} \\ \frac{\partial r^*}{\partial \pi} = −\frac{g_0}{[\pi (s−\alpha)−\beta]^2} <0 \]

- The growth rate also reacts negatively to a rising profit share \[ g^* = g_0 + \alpha r^* + \beta u^* = \frac{g_0 \pi s}{\pi (s−\alpha)−\beta} \\ \frac{\partial g^*}{\partial \pi} = −\frac{g_0 s \beta}{[\pi (s−\alpha)−\beta]^2} <0 \]

Third generation: Bhaduri-Marglin

- Focus on the profit share \(\pi\) instead of the profit rate \(r\) in the investment function \[ g_I = g_0 + \alpha \pi + \beta u \]

- Capacity utilization reacts negatively to a rising profit share \[ s \pi u = g_0 + \alpha \pi + \beta u \\ u^* = \frac{g_0 + \alpha \pi}{s\pi - \beta} \\ \frac{\partial u^*}{\partial \pi} = −\frac{sg_0 + \alpha\beta}{(s\pi - \beta)^2} <0 \]

- Change in the profit rate is now ambiguous \[ r^* = \pi u^* = \frac{\pi(g_0 + \alpha\pi)}{s\pi - \beta} \\ \frac{\partial r^*}{\partial \pi} = \frac{\alpha\pi - u^* \beta}{s\pi − \beta} < \mathtt{or} >0 \]

- Same for the growth rate \[ g^* = g_0 + \alpha\pi + \beta u^* = \frac{s\pi(g_0 + \alpha\pi)}{s\pi - \beta} \\ \frac{\partial g^*}{\partial \pi} = \frac{s(\alpha\pi - \beta u^*)}{s\pi - \beta} < \mathtt{or} > 0 \]

- There are now two cases: \[ \frac{\partial g^*}{\partial \pi} = \begin{cases} >0: \alpha\pi > \beta u^* & \mathtt{profit−led} \\ <0: \alpha\pi < \beta u^* & \mathtt{wage-led} \end{cases} \]

Wage-led/profit-led debate

- Seminal theoretical paper: Bhaduri/Marglin (1990)

- Wage-led vs. profit-led: When income is redistributed towards labour, does investment react more strongly to higher demand or to the lower profit rate?

- First empirical estimate: Bowles/Boyer (1995)

- Taken up by Post-Keynesians

- in Europe (Hein, Onaran, Stockhammer, etc.): Neo-Kaleckians, wage-led

- and in the US (Taylor, etc.): Neo-Goodwinians, profit-led

Components of demand

\[ Y = C + I + NX \]

Which components increase when income is redistributed towards labour?

- Consumption \(C\): rises

- Investments \(I\): depends on firm‘s reaction to higher demand vs. lower profit rate

- Net exports \(NX\): imports rise, exports fall \(\rightarrow NX\) fall

It’s an empirical question

| Wage share ↑ | Consumption | Investment | Net exports | Dom. demand | Total demand |

|---|---|---|---|---|---|

| 🇪🇺 | ↑ | ↓ | ↓ | ↑ | ↑ |

| 🇩🇪 | ↑ | ↓ | ↓ | ↑ | ↑ |

| 🇫🇷 | ↑ | ↓ | ↓ | ↑ | ↑ |

| 🇮🇹 | ↑ | ↓ | ↓ | ↑ | ↑ |

| 🇬🇧 | ↑ | ↓ | ↓ | ↑ | ↑ |

| 🇺🇸 | ↑ | ↓ | ↓ | ↑ | ↑ |

| 🇯🇵 | ↑ | ↓ | ↓ | ↑ | ↑ |

| 🇨🇦 | ↑ | ↓ | ↓ | ↑ | ↓ |

| 🇦🇺 | ↑ | ↓ | ↓ | ↑ | ↓ |

| 🇲🇽 | ↑ | ↓ | ↓ | ↑ | ↓ |

| 🇦🇷 | ↑ | ↓ | ↓ | ↑ | ↓ |

| 🇨🇳 | ↑ | ↓ | ↓ | ↑ | ↓ |

| 🇮🇳 | ↑ | ↓ | ↓ | ↑ | ↓ |

| 🇿🇦 | ↑ | ↓ | ↓ | ↑ | ↓ |

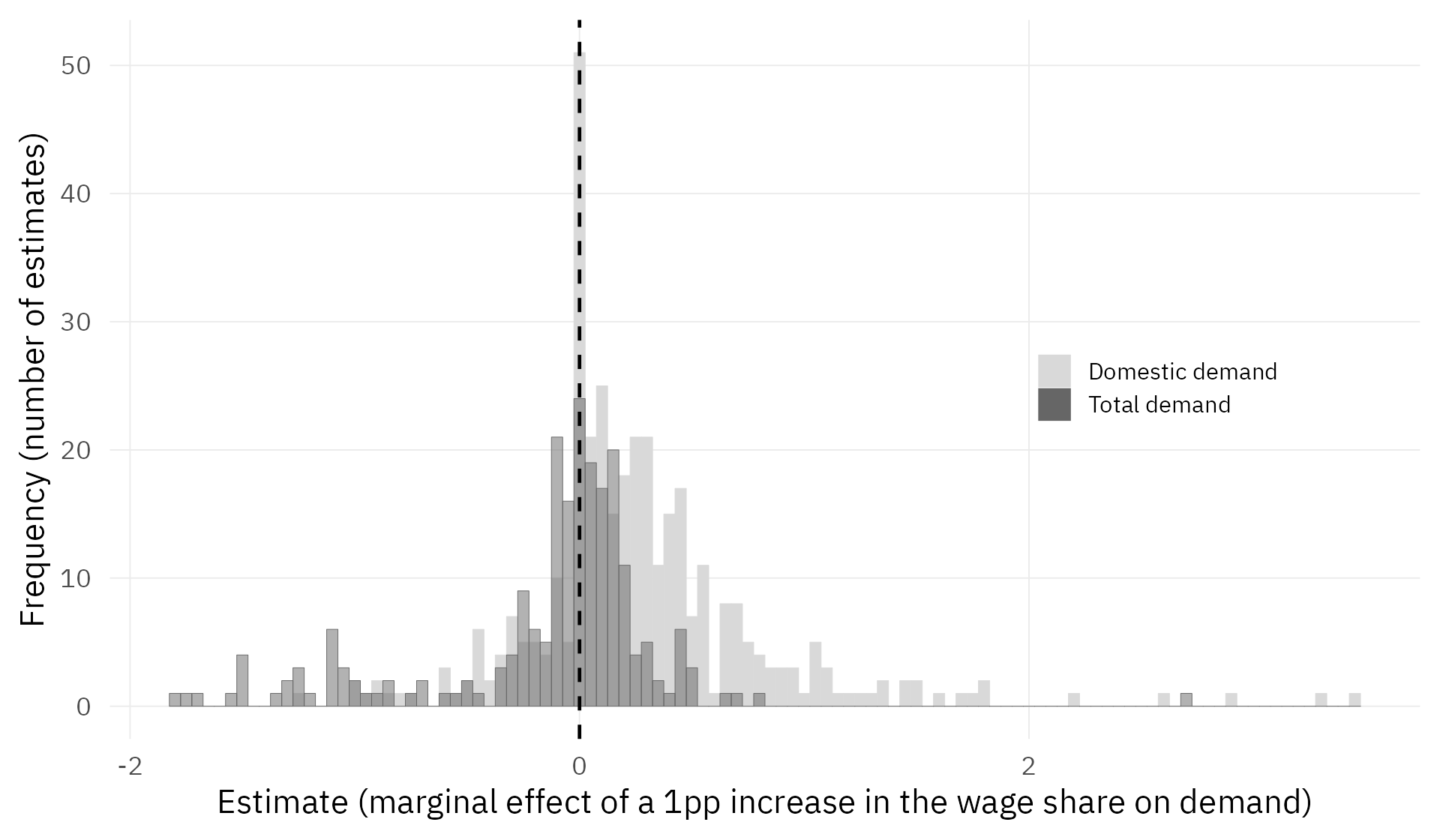

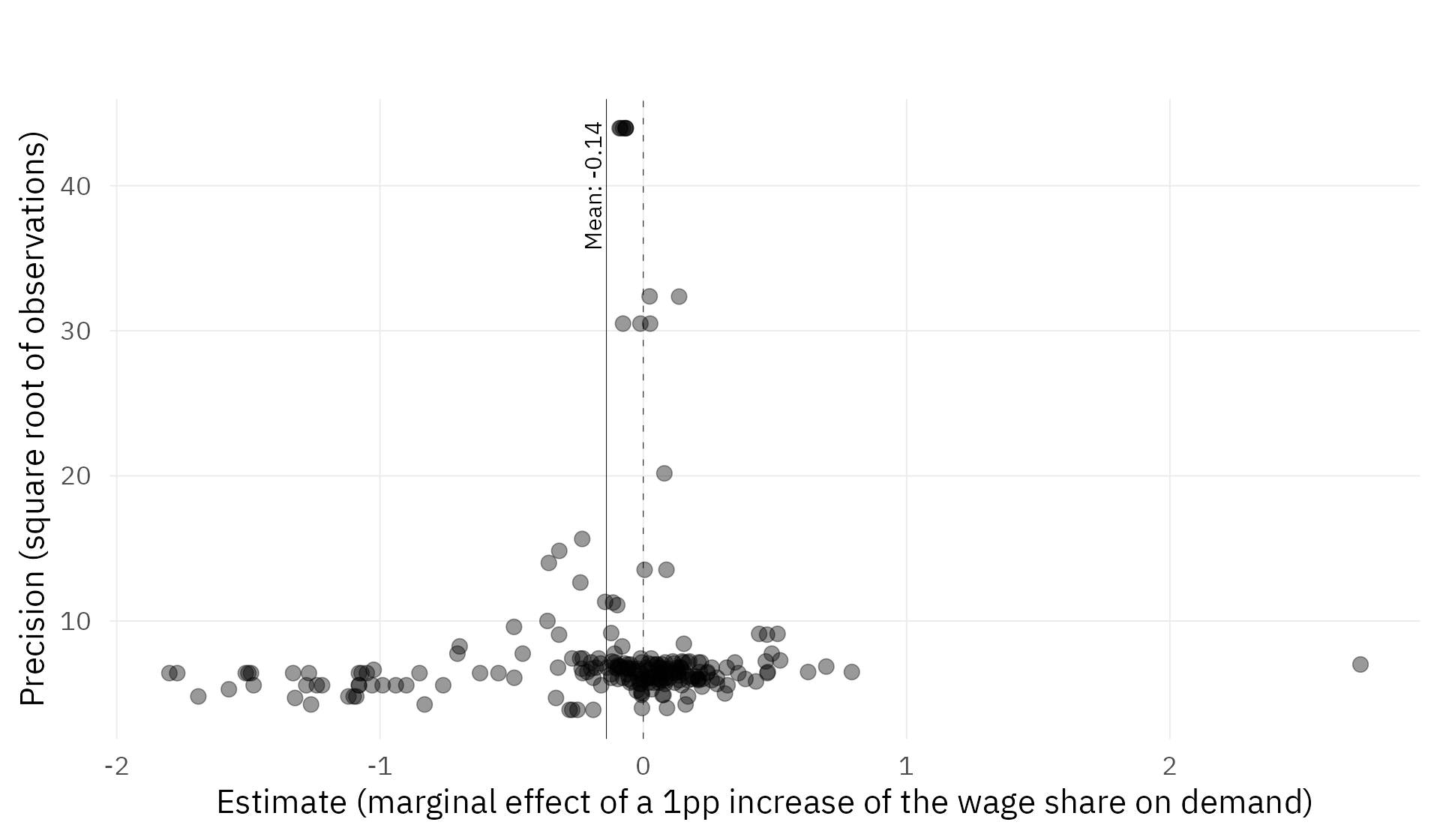

Meta-Regression analysis

In a new working paper (Dammerer et al., 2022), we study

- 578 estimates for the relationship between functional distribution and aggregate demand

- from 33 empirical studies

- over 163 years and 59 countries and regions

- whereof 218 estimates refer to total demand and 360 to domestic demand

Histogram of estimates

Funnel plot for total demand

Funnel plot for domestic demand

Bibliography

PI 2159 Special Topics in Economic Policy | Winter term 2022/23