The economics of inequality

Recent research on wealth inequality

Dr. Matthias Schnetzer

November 11, 2022

Recap

- Which trend can you identify for the wage share in most European countries and why is that?

- What are Kuznets Waves?

- What does the elephant curve by Branko Milanovic show?

- What are malign and benign factors that might lead to a decrease in global inequality?

What is wealth and how do we measure it?

![]()

Definition of private wealth

Non-financial assets

- Dwellings (owner-occupied residence, other real estate)

- Consumer durables (vehicles, etc.)

- Valuables

- Intellectual property

Financial assets

- Currency and deposits

- Net equity in own unincorporated business

- Mututal funds and investment funds

- (Private) Pensions funds

- Bonds and other debt securities

- Shares and other equity

- Life insurance funds -Other financial assets

Liabilities

- Owner-occupied residence loans

- Consumer durable loans (e.g. for vehicles)

- Other investment loans (collateralized)

- Other loans (e.g. education loans)

No human, social and cultural capital; No public social security pensions (marketable vs. augmented wealth)

HFCS versus National Accounts

| Underreporting in HFCS in % of NA | Tangible assets | Financial wealth | Liabilities | Net wealth |

|---|---|---|---|---|

| Austria | -8 | 62 | 59 | 12 |

| Germany | 15 | 58 | 29 | 30 |

| France | 17 | 61 | 33 | 32 |

| Spain | 16 | 63 | 39 | 24 |

| Italy | -5 | 80 | 60 | 23 |

| Belgium | -21 | 42 | 24 | 6 |

| Finland | -1 | 63 | 12 | 22 |

| Netherlands | 13 | 86 | 16 | 47 |

Why is there underreporting in HFCS?

- Target population in Austria: 3.9 million households

- Gross sample in HFCS 2017: 6,280 households

- Realized interviews: 3,072 households

- Response rate in HFCS 2017: approx. 50%

- Residual: refused interviews, invalid addresses, households not available, etc.

- Response refusal correlates with wealth and is highest at the top (Vermeulen, 2016)

- Wealthy households own a greater number of assets and miss some components more easily (Kennickell/Woodburn, 1999)

How to deal with the missing top in wealth surveys?

![]()

Upstream strategy: Oversampling

- Undercoverage and Underreporting

- Oversampling is crucial for wealth surveys

- Oversampling in HFCS 2017: 🇧🇪 🇨🇾 🇩🇪 🇪🇪 🇪🇸 🇫🇮 🇫🇷 🇬🇷 🇭🇷 🇭🇺 🇮🇪 🇱🇻 🇱🇹 🇱🇺 🇵🇱 🇵🇹 🇸🇰

- No oversampling: 🇦🇹 🇮🇹 🇲🇹 🇳🇱 🇸🇮

- How does oversampling work?

- External personal wealth data (🇫🇷 🇪🇸)

- List of streets with high-income people (🇩🇪 🇸🇰)

- Income tax data (🇱🇺 20% of the sample from top 10% earners)

- Regions with higher average income (🇵🇱)

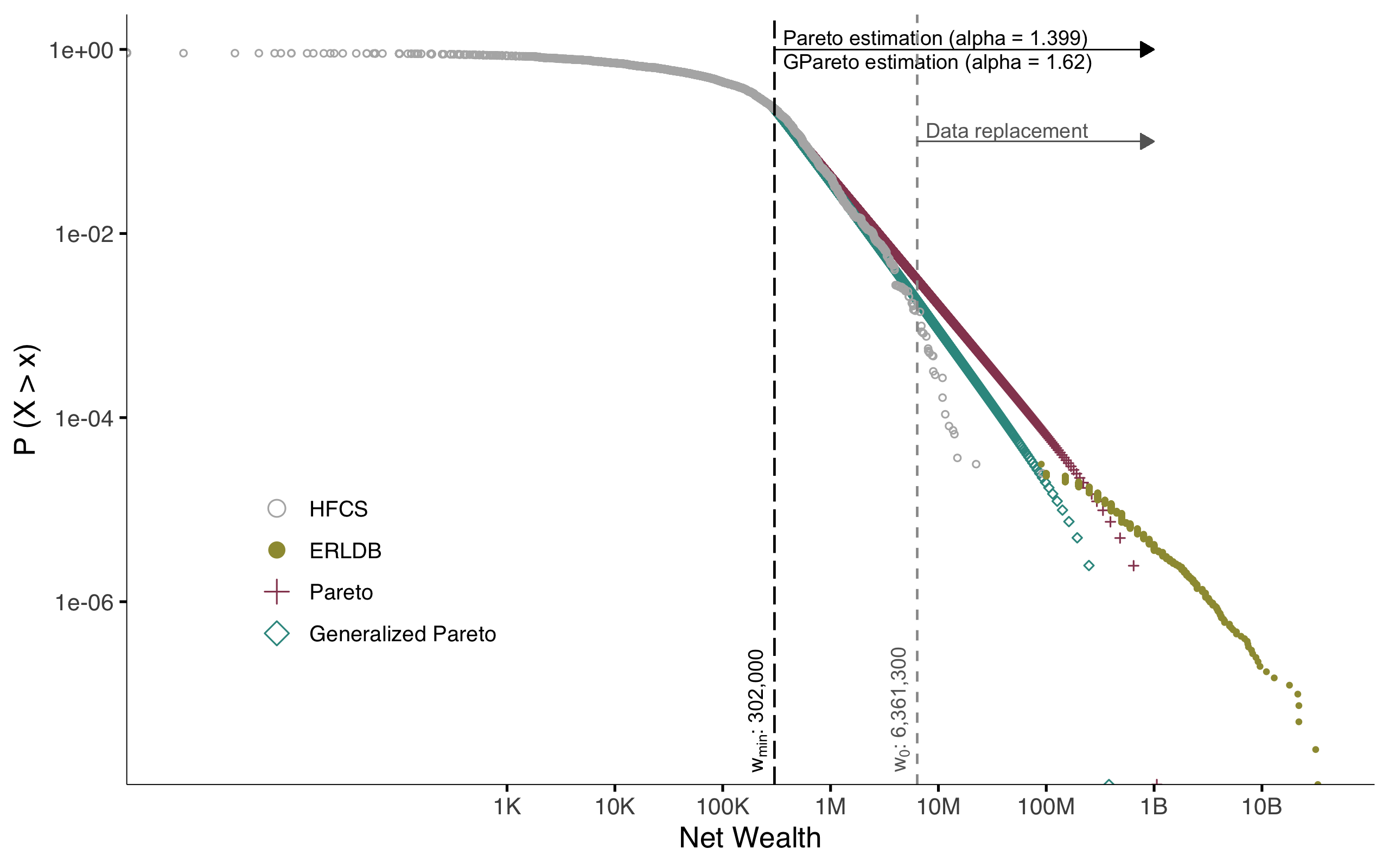

Downstream strategy: Pareto estimation

- Pareto-Distribution is a sensible approximation to the distribution of large wealth

- Two parameters:

- Threshold for “large” wealth \(m\)

- Pareto-Index \(\alpha\)

\[P_i(x_i) = Pr(X_i \leqslant x_i) = 1 - \left(\frac{m_i}{x_i}\right)^{\alpha_i}\] \[\forall ~\text{implicates} ~i = 1...5 \wedge x_i \geqslant m_i\]

A smaller \(\alpha\) means greater inequality. Empirically, \(\alpha\) often is around 1.5 for wealth.

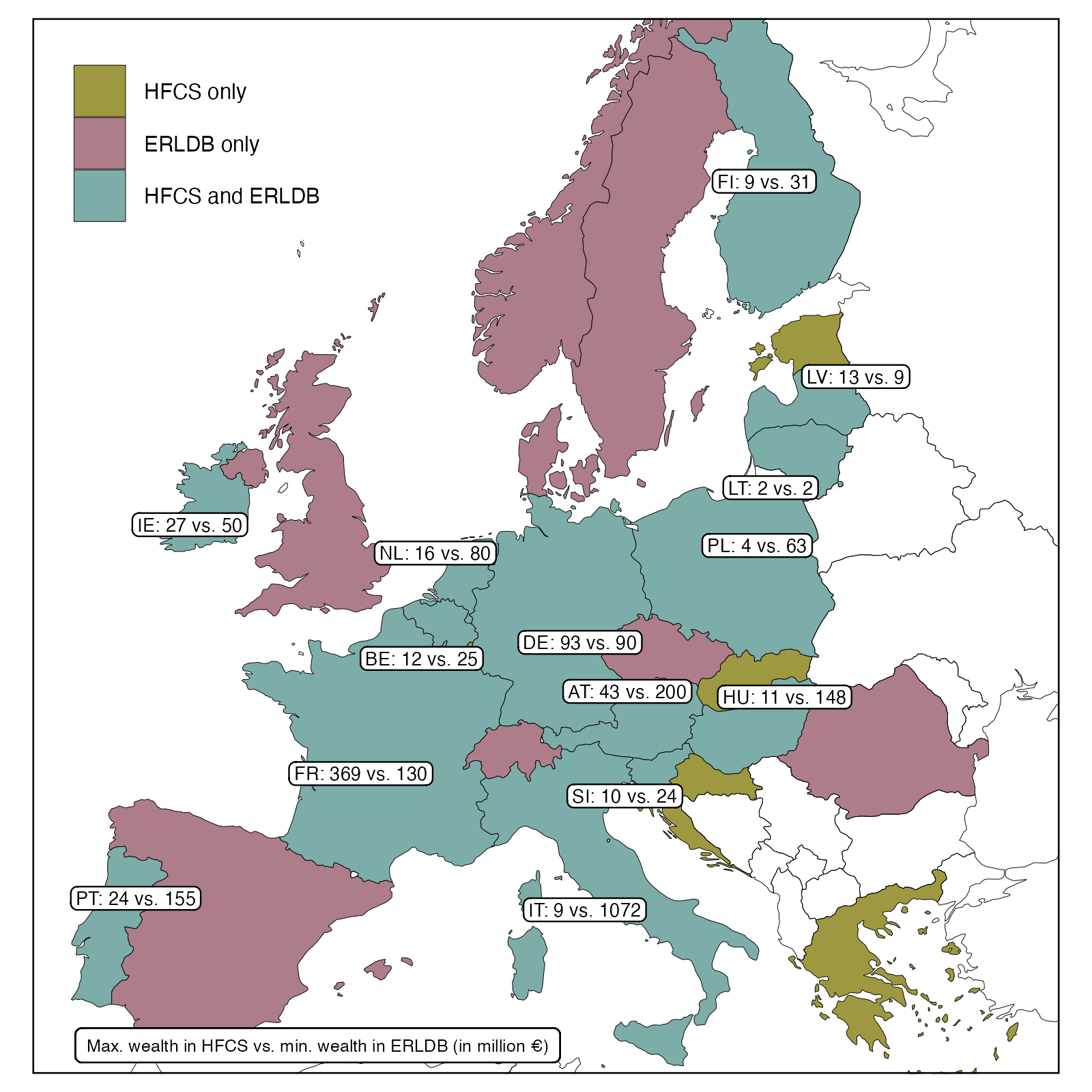

European Rich List Database (ERLDB) and HFCS

Cumulative density function of wealth in Germany

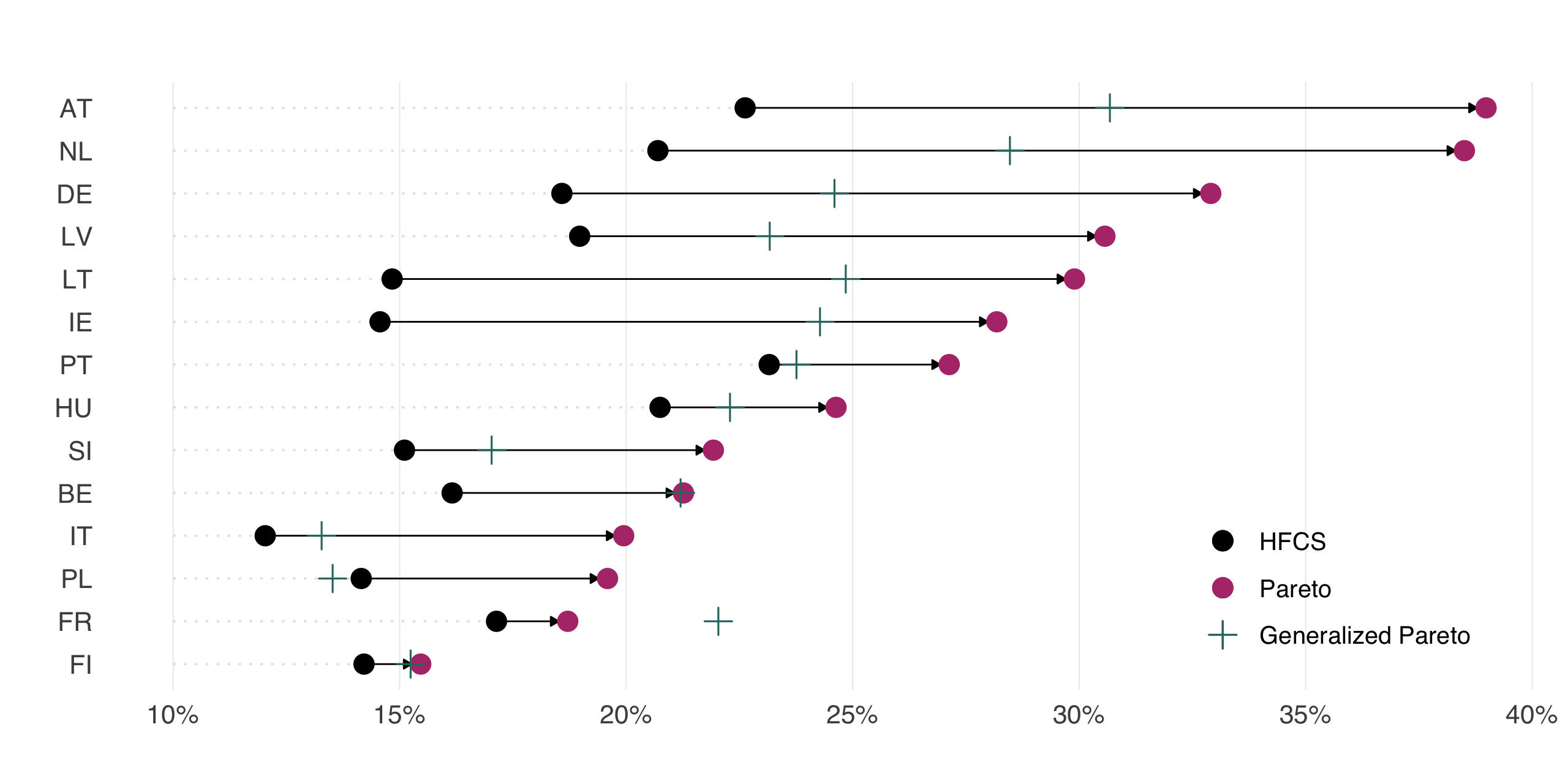

Adjustment of top 1% shares

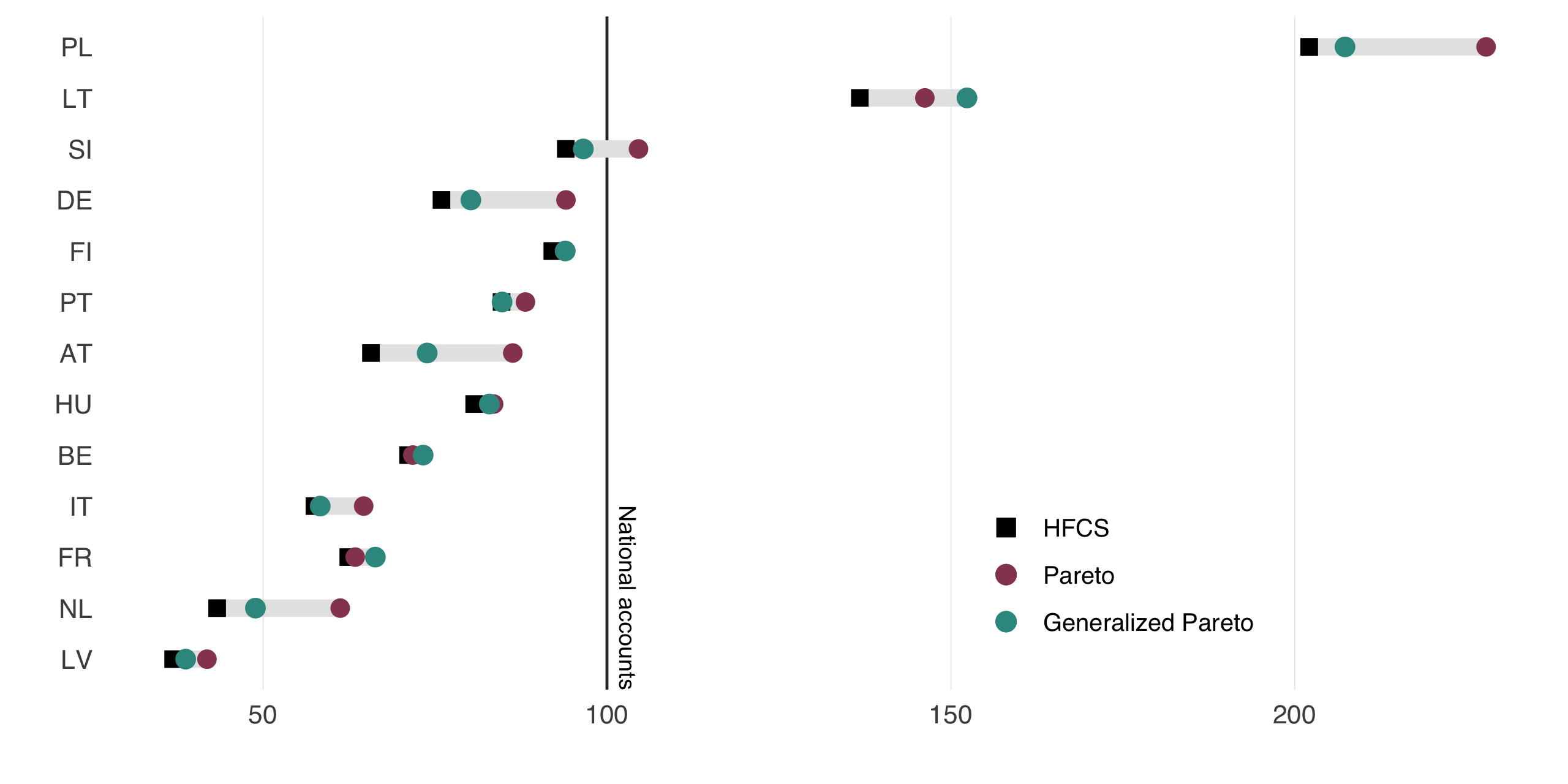

Convergence of adjusted survey data and national accounts

Wealth distribution in Austria

![]()

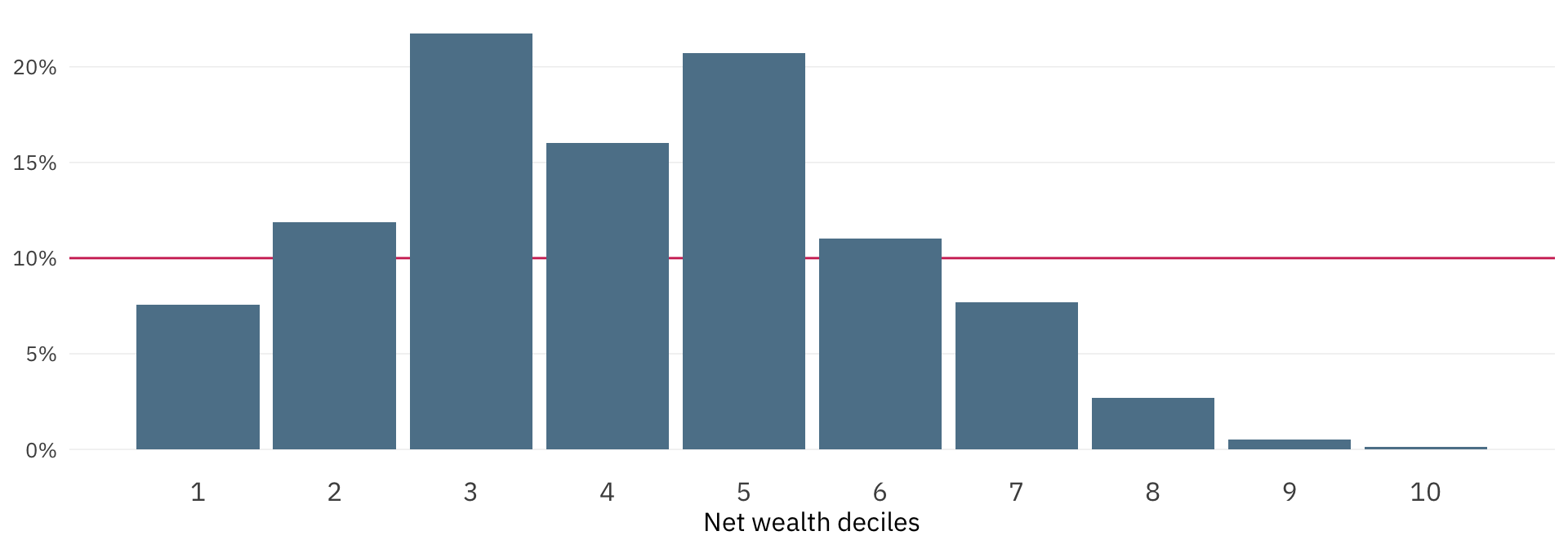

Self-positioning in the wealth distribution

- Correct positioning of households in the richest decile: 0

- Average estimated decile in the richest decile: 6

- Average estimated decile in the poorest decile: 3

Net wealth distribution in Austria

Median: 83,000€

Average net wealth

of total population:

318,000€

Average net wealth

of top 1%:

12,500,000€

Alternative figure for wealth distribution

Participation in wealth components

| Participation in % | Bottom half (0-50%) |

Upper middle (51-80%) |

Affluent (91-95%) |

Top 5% (96-100%) |

|---|---|---|---|---|

| Vehicles | 65.5 | 87.4 | 93.2 | 97.4 |

| Owner-occupied residence | 6.2 | 80.3 | 94.1 | 93.2 |

| Other real estate | 2.8 | 14.7 | 27.9 | 60.8 |

| Business wealth | 2.1 | 4.8 | 13.3 | 50.2 |

| Deposits | 99.4 | 99.6 | 99.3 | 100.0 |

| Saving accounts | 80.1 | 91.1 | 95.5 | 97.7 |

| Mutual and investment funds | 3.6 | 8.1 | 19.6 | 26.9 |

| Bonds | 1.2 | 2.8 | 5.0 | 9.7 |

| Shares | 1.9 | 5.8 | 10.1 | 15.0 |

Gender net wealth gap in Austria

| Mean wealth | Mean GWG (in €) | Mean GWG (in %) | Median Wealth | Median GWG (in €) | Median GWG (in %) | |

|---|---|---|---|---|---|---|

| All respondents | ||||||

| Couples | 356,553 | 173,683 | ||||

| Male | 207,485 | 58,417 | 28 | 82,285 | 13,862 | 17 |

| Female | 149,068 | 68,422 | ||||

| Male respondent | ||||||

| Male | 270,307 | 110,995 | 41.1 | 99,347 | 27,085 | 27.3 |

| Female | 159,312 | 72,262 | ||||

| Female respondent | ||||||

| Male | 138,830 | 957 | 0.7 | 63,825 | −1,395 | -2.2 |

| Female | 137,873 | 65,220 |

Migrant net wealth gap in Austria

| Mean wealth | Mean MWG (in €) | Mean MWG (in %) | Median Wealth | Median MWG (in €) | Median MWG (in %) | |

|---|---|---|---|---|---|---|

| Natives | 165,730 | 59,001 | ||||

| Migrants | ||||||

| Total | 98,007 | 67,723 | 41 | 15,931 | 43,070 | 73 |

| 1st generation | 63,001 | 102,729 | 62 | 9,917 | 49,084 | 83 |

| 2nd generation | 139,775 | 25,955 | 16 | 32,763 | 26,238 | 44 |

| 1st generation migrants only | ||||||

| Short stay | 39,598 | 126,132 | 76 | 4,935 | 54,066 | 92 |

| Long stay | 86,317 | 79,413 | 48 | 20,196 | 38,805 | 66 |

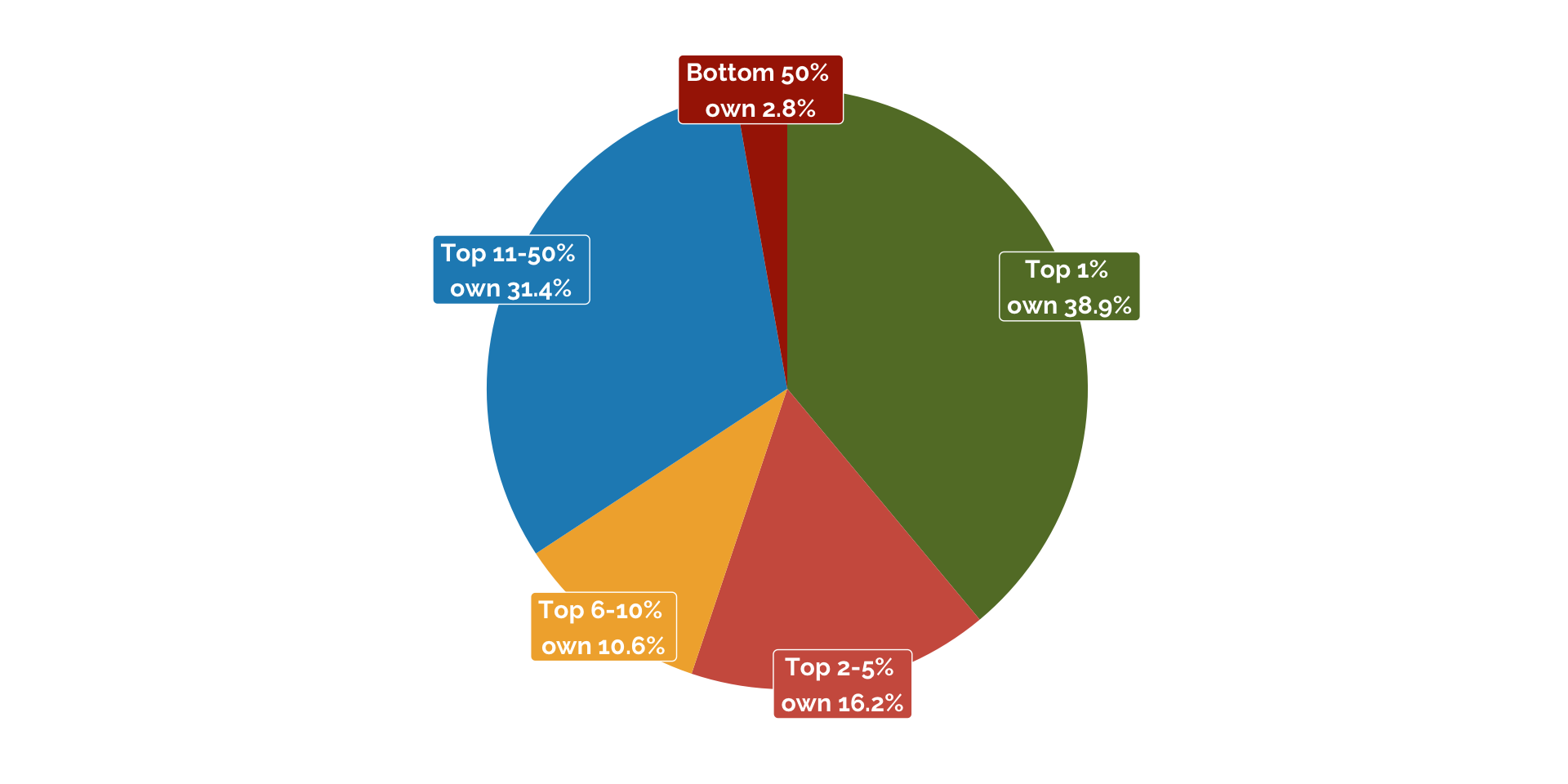

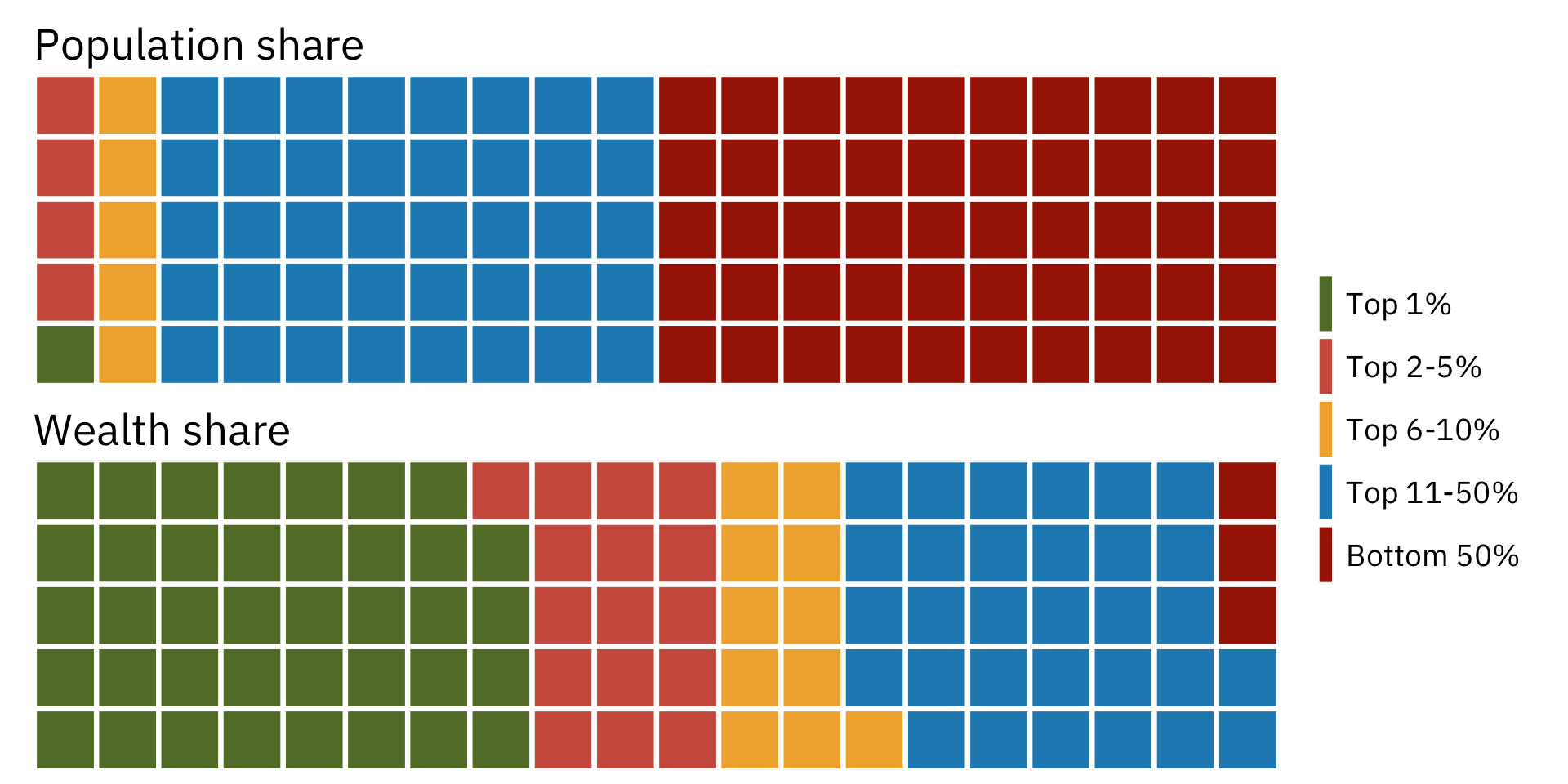

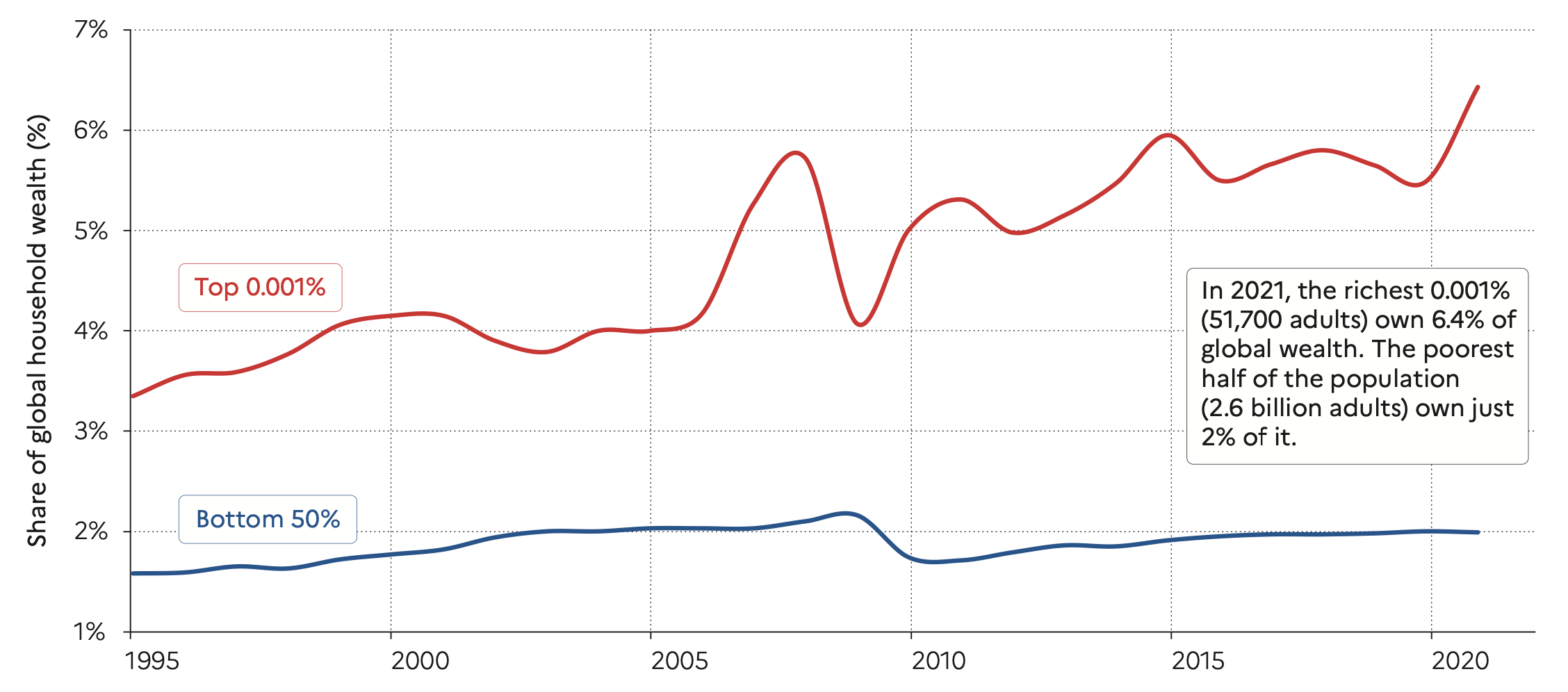

Global wealth distribution

![]()

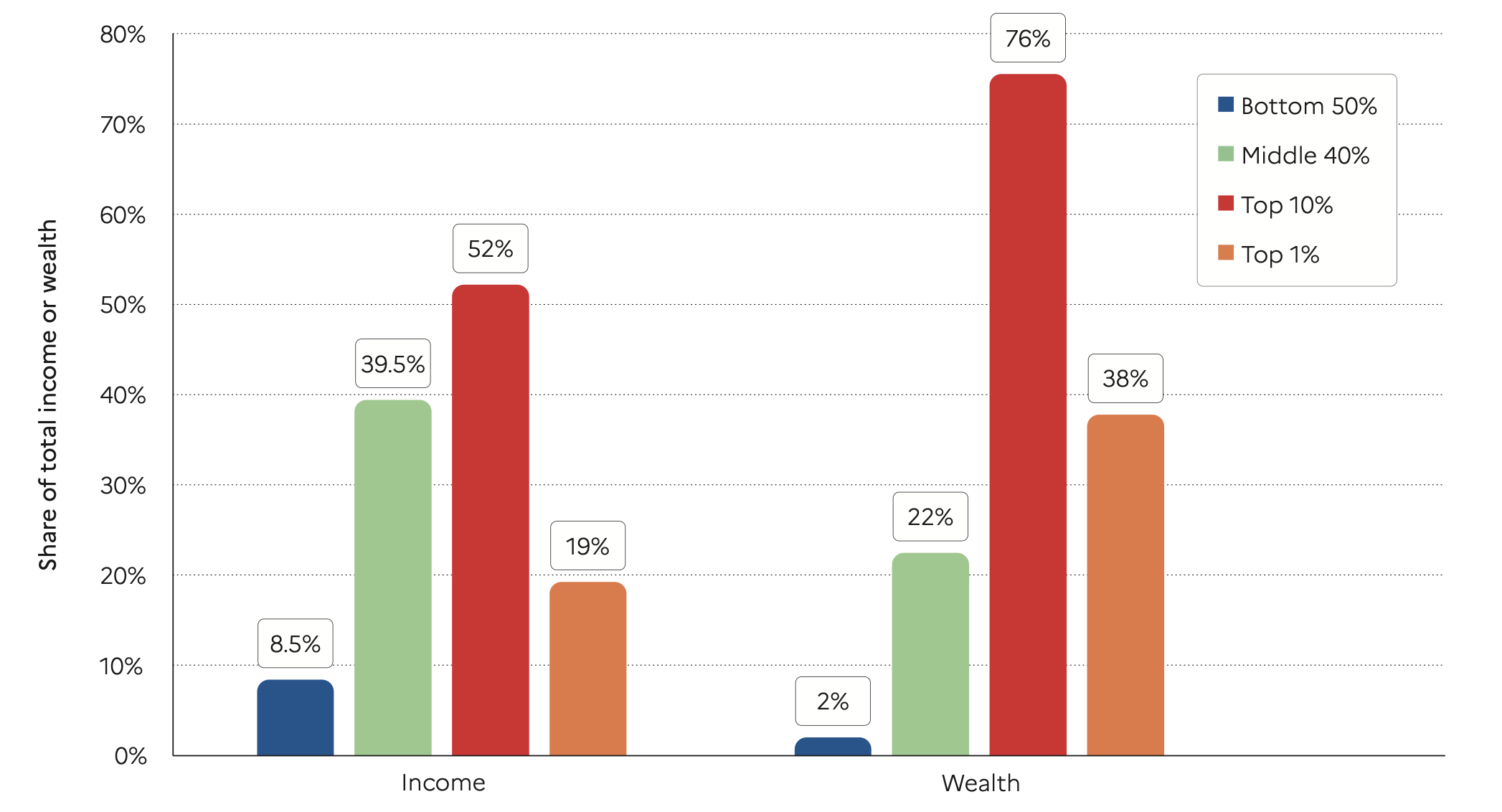

Global income and wealth inequality

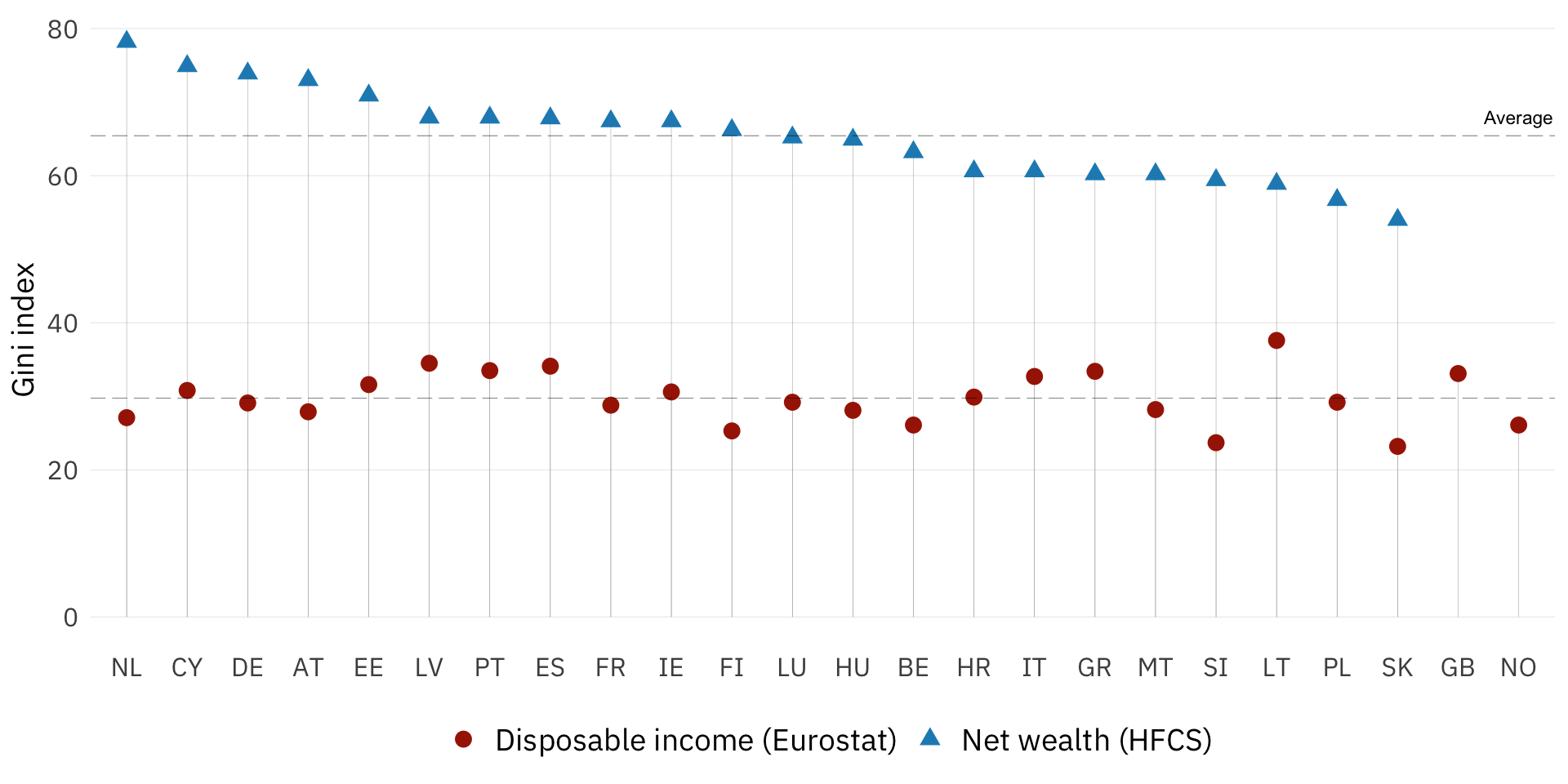

Income and wealth inequality across Europe

Extreme global wealth inequality

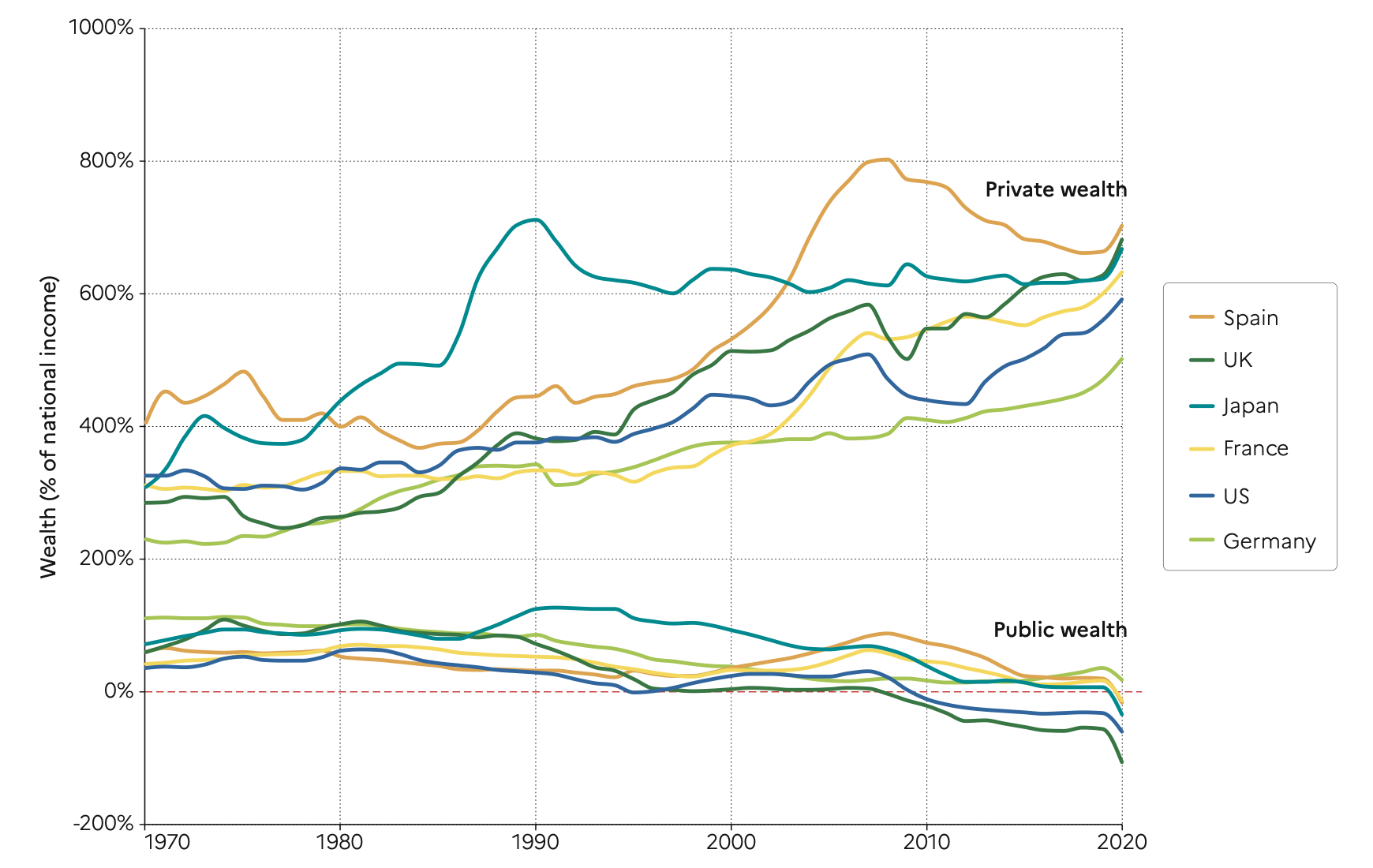

Private and public wealth

Bibliography

PI 2159 Special Topics in Economic Policy | Winter term 2022/23

Chancel, Lucas/Piketty, Thomas/Saez, Emmanuel/Zucman, Gabriel (2022). World inequality report 2022. World Inequality Lab.

Gabaix, Xavier (2016). Power laws in economics: An introduction. Journal of Economic Perspectives, 30(1), 185–206. DOI: 10.1257/jep.30.1.185

Heck, Ines/Kapeller, Jakob/Wildauer, Rafael (2020). Vermögenskonzentration in Österreich – ein update auf basis des HFCS 2017 (AK Working Paper No. 206). AK Wien.

Kennickell, Arthur B./Woodburn, R. Louise (1999). Consistent weight design for the 1989, 1992 and 1995 SCFs, and the distribution of wealth. Review of Income and Wealth, 45(2), 193–215. DOI: 10.1111/j.1475-4991.1999.tb00328.x

Muckenhuber, Mattias/Rehm, Miriam/Schnetzer, Matthias (2022). A tale of integration? The migrant wealth gap in austria. European Journal of Population, 38(2), 163–190. DOI: 10.1007/s10680-021-09604-1

OECD (2013). OECD guidelines for micro statistics on household wealth. OECD. DOI: 10.1787/9789264194878-en

Rehm, Miriam/Schneebaum, Alyssa/Schuster, Barbara (2022). Intra-couple wealth inequality: What’s socio-demographics got to do with it? European Journal of Population, 38(4), 681–720. DOI: 10.1007/s10680-022-09633-4

Vermeulen, Philip (2016). Estimating the top tail of the wealth distribution. The American Economic Review, 106(5), 646–650. DOI: 10.1257/aer.p20161021