The economics of inequality

Evolution of inequality

Dr. Matthias Schnetzer

November 04, 2022

Recap

- Which data sources for the measurement of income do you know?

- How do they measure income and what are their drawbacks?

- How do we calculate the functional distribution of income?

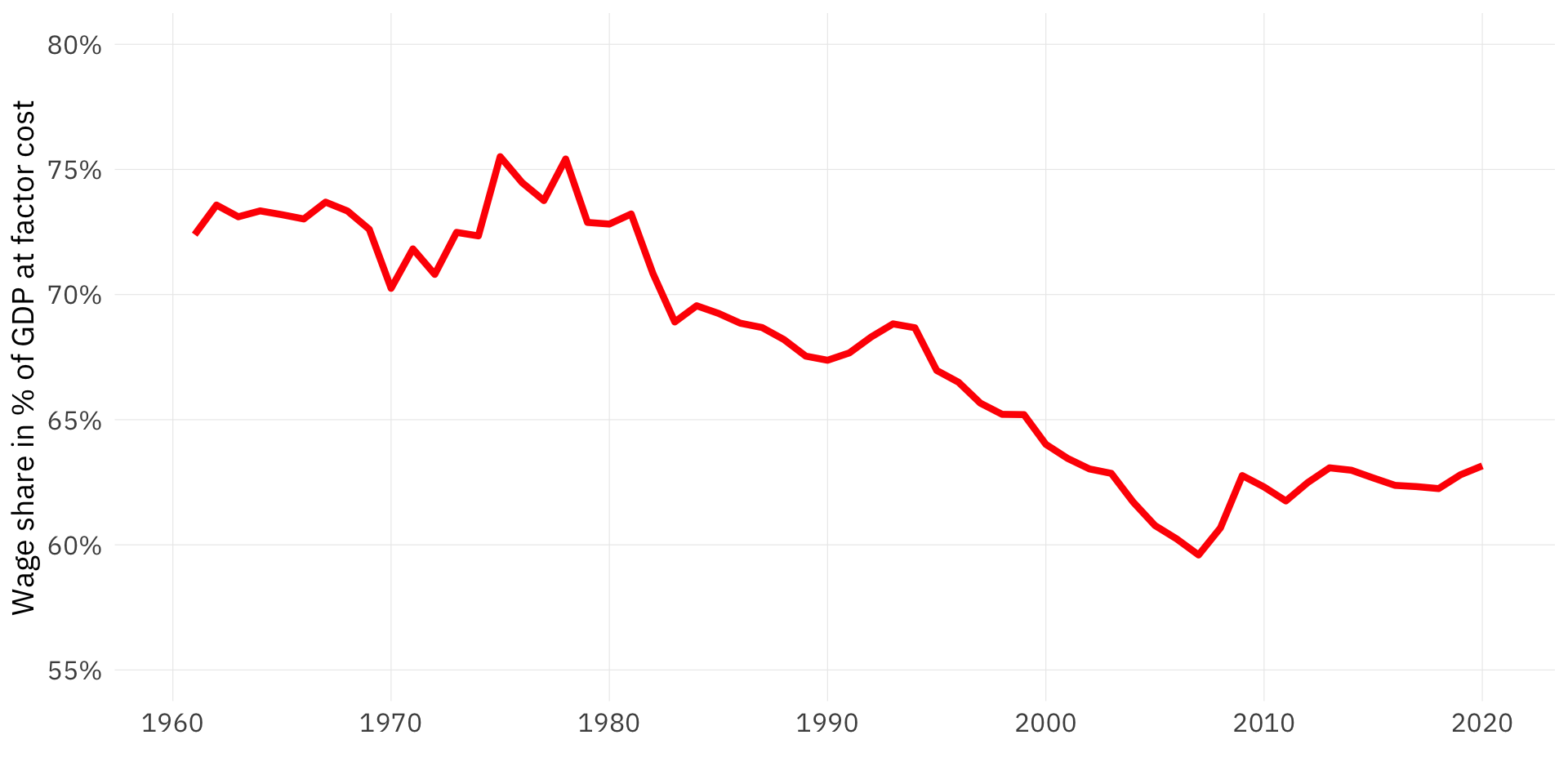

Changes in the wage share since the 1980s

![]()

The wage share in Austria

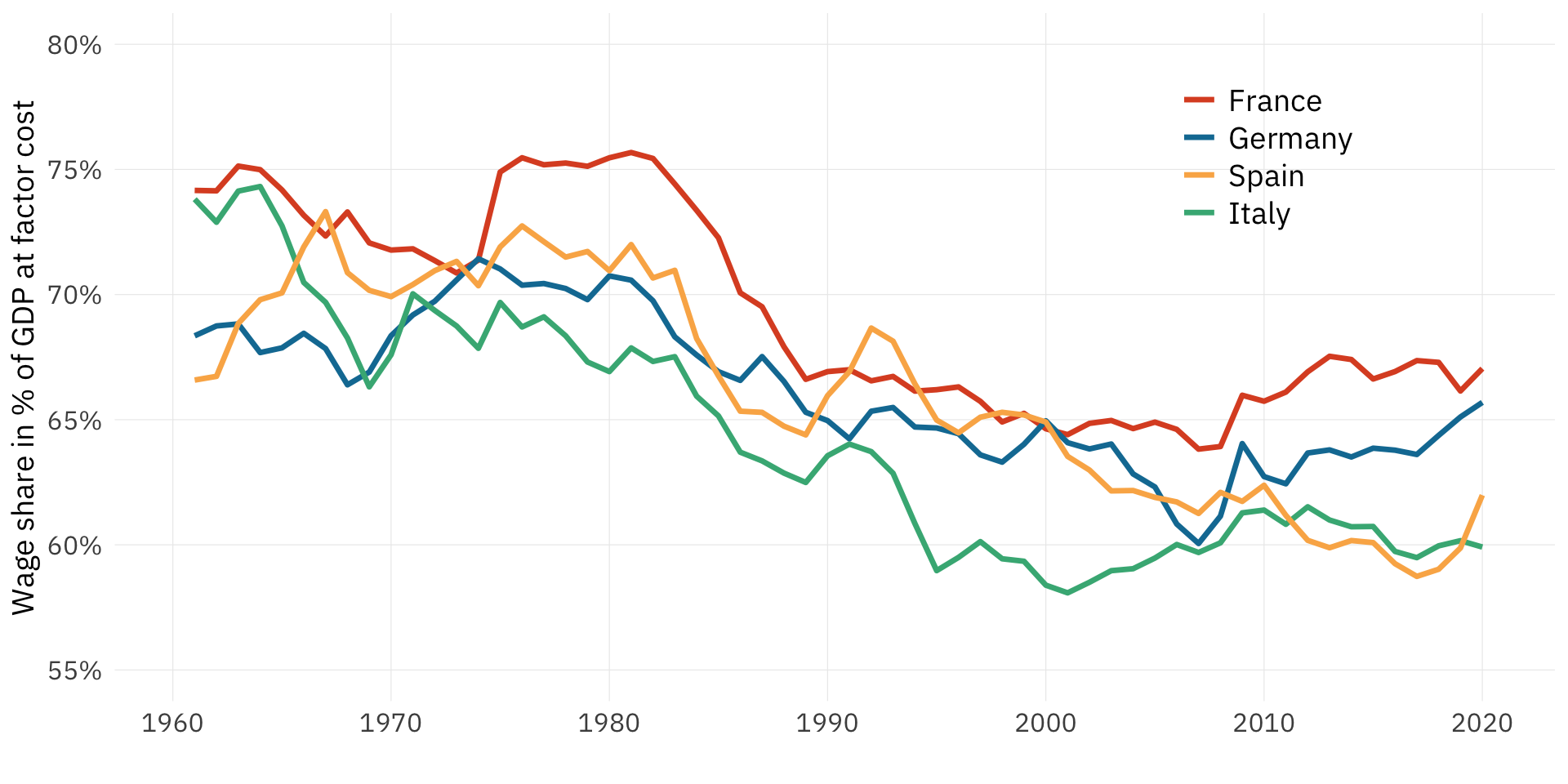

Functional income distribution in Continental Europe

Functional distribution in Anglosaxon countries

Factors influencing the wage share

- Labour market

Organization (e.g. collective bargaining, workers councils) Leverage (e.g. unemployment rate, strength of unions) - Product markets

Globalization Technological change - Politics

Influence of capital income earners

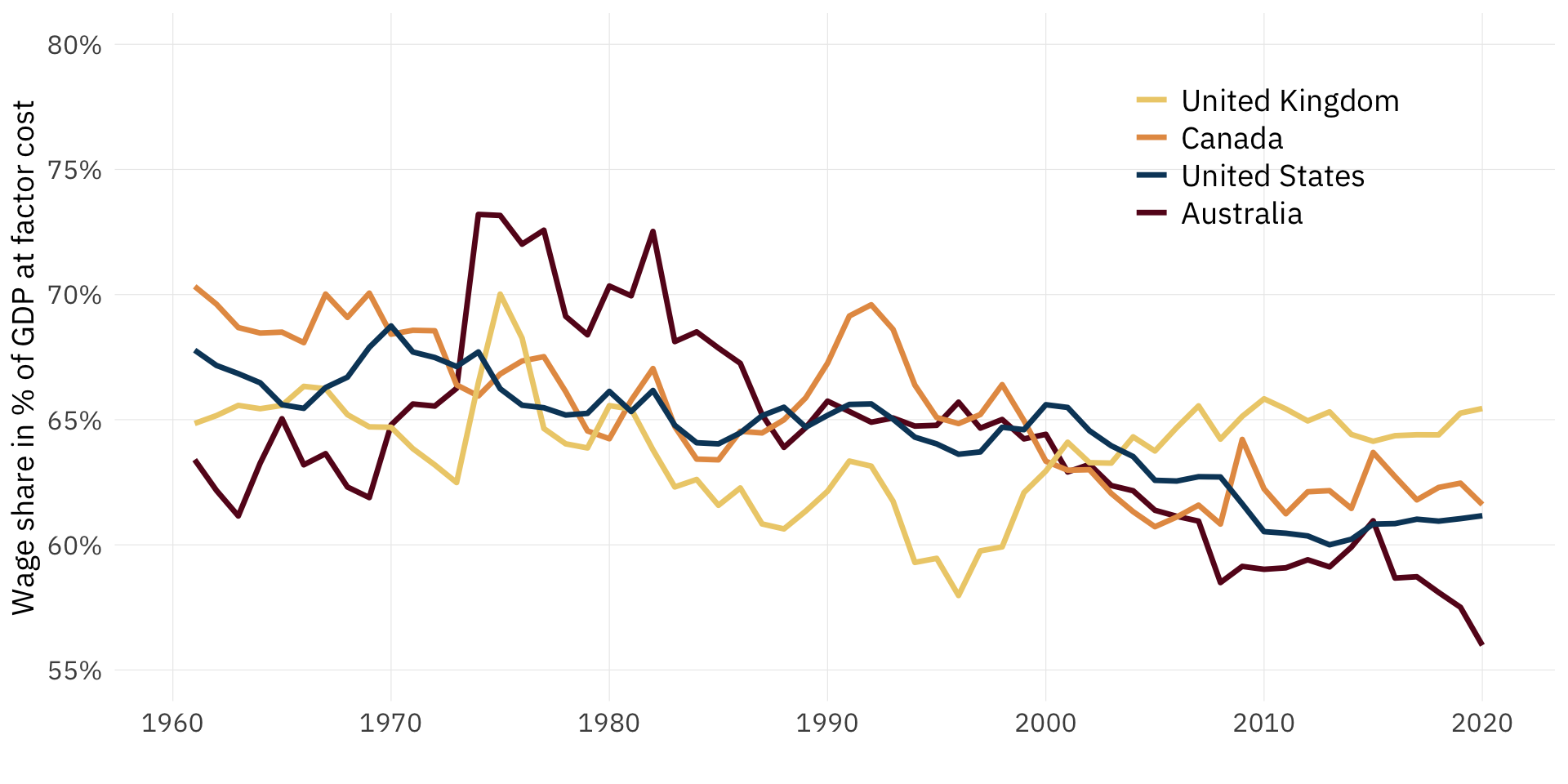

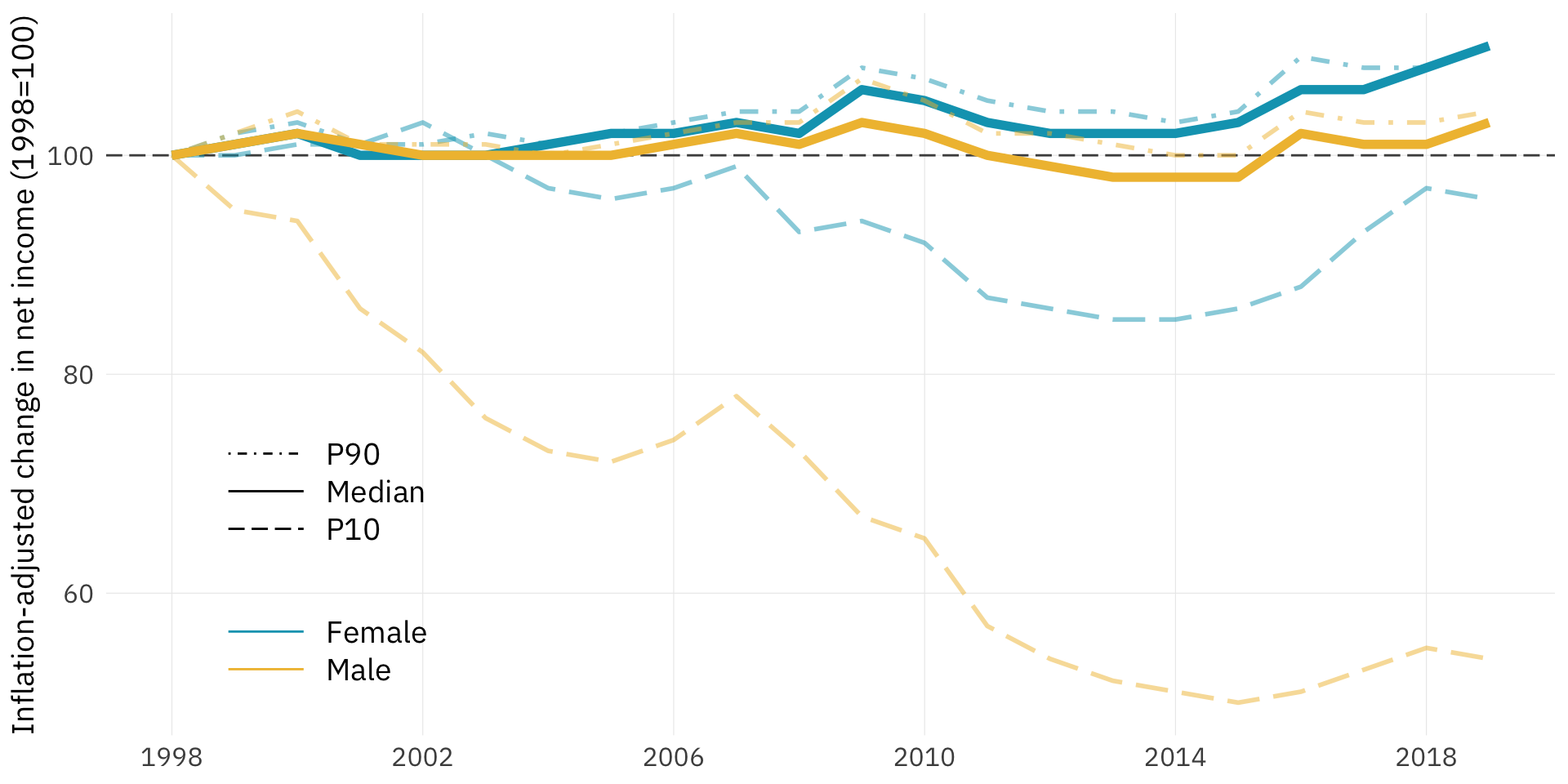

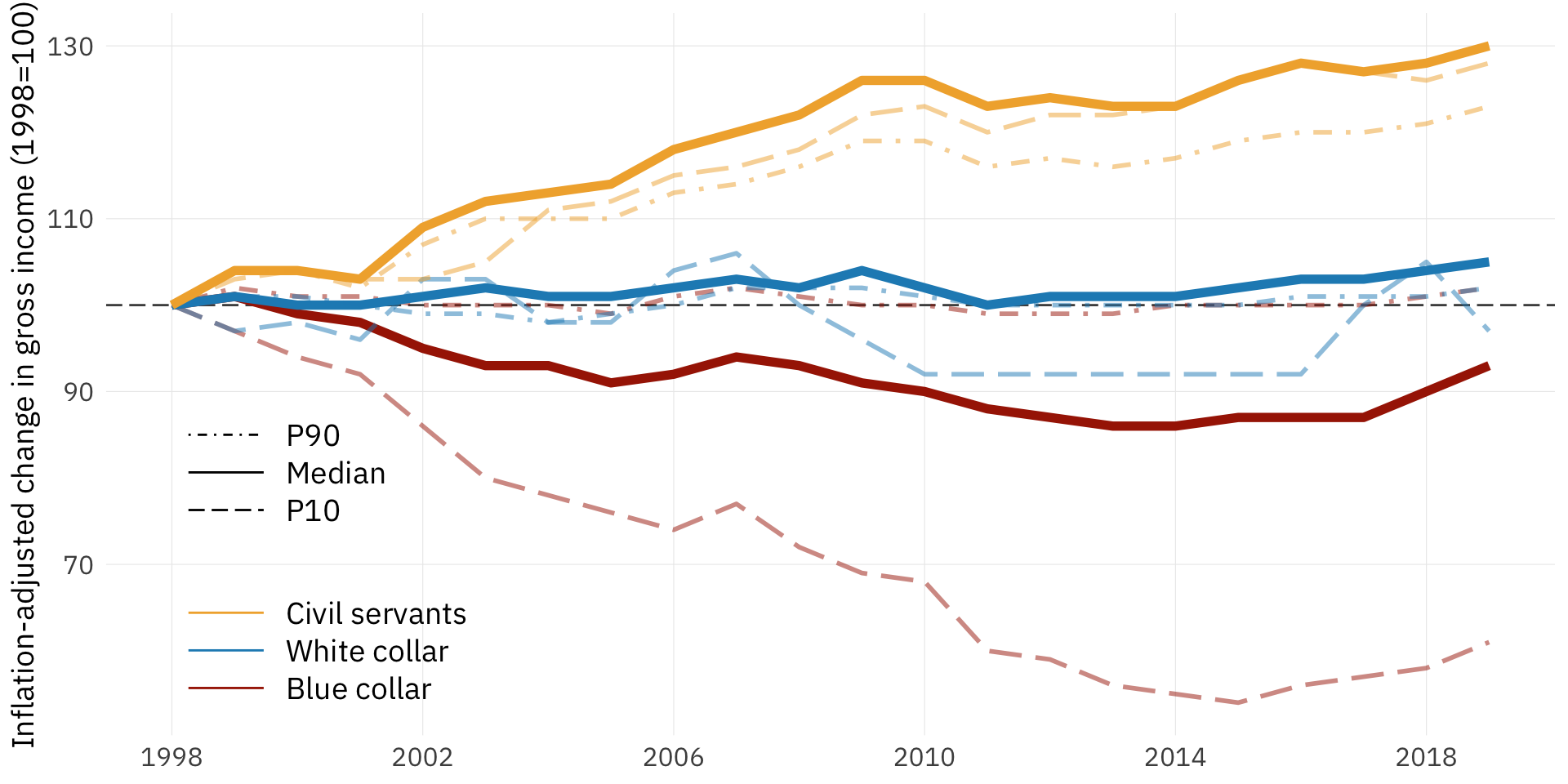

Changes in personal income inequality in Austria

![]()

Net annual income of employees

Net annual income by gender

Gross annual income by social status

Evolution of the Gender Pay Gap

The evolution of global inequality

![]()

Historical development of inequality: 3 views

Determinants of the change in inequality

Increase

- Rents:

- Technological revolution

- Globalization

- Cumulative causation:

- Capital income

- Homogamy

- Political influence

Decrease

- Benign factors:

- Rising education (decreasing education premium)

- Low-skill biased technological progress

- Labour scarcity

- Global income compression

- Social political pressure (e.g. unions)

- Malign factors:

- Wars

- Social unrest

- Epidemics (see also Scheidel, 2018)

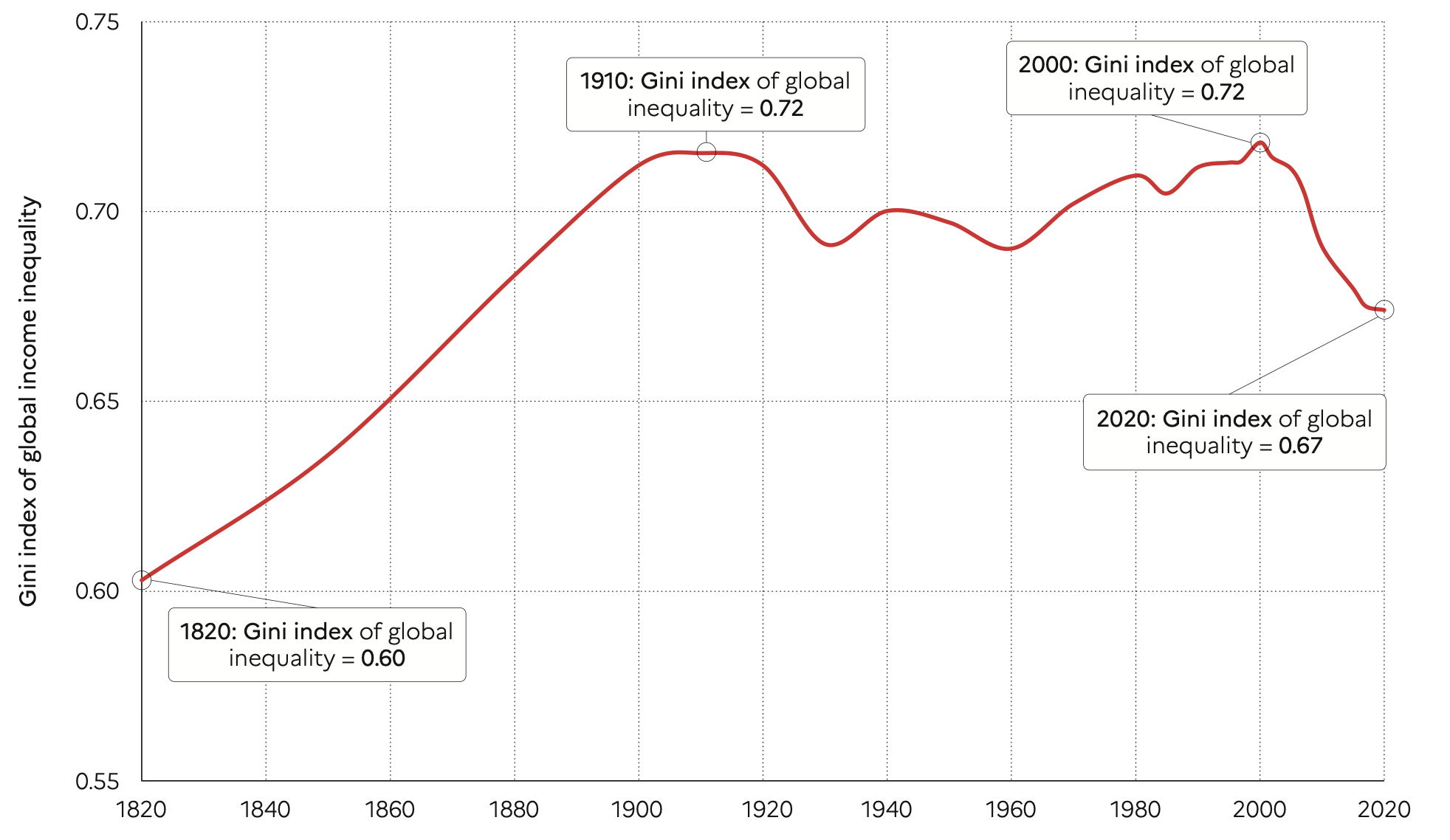

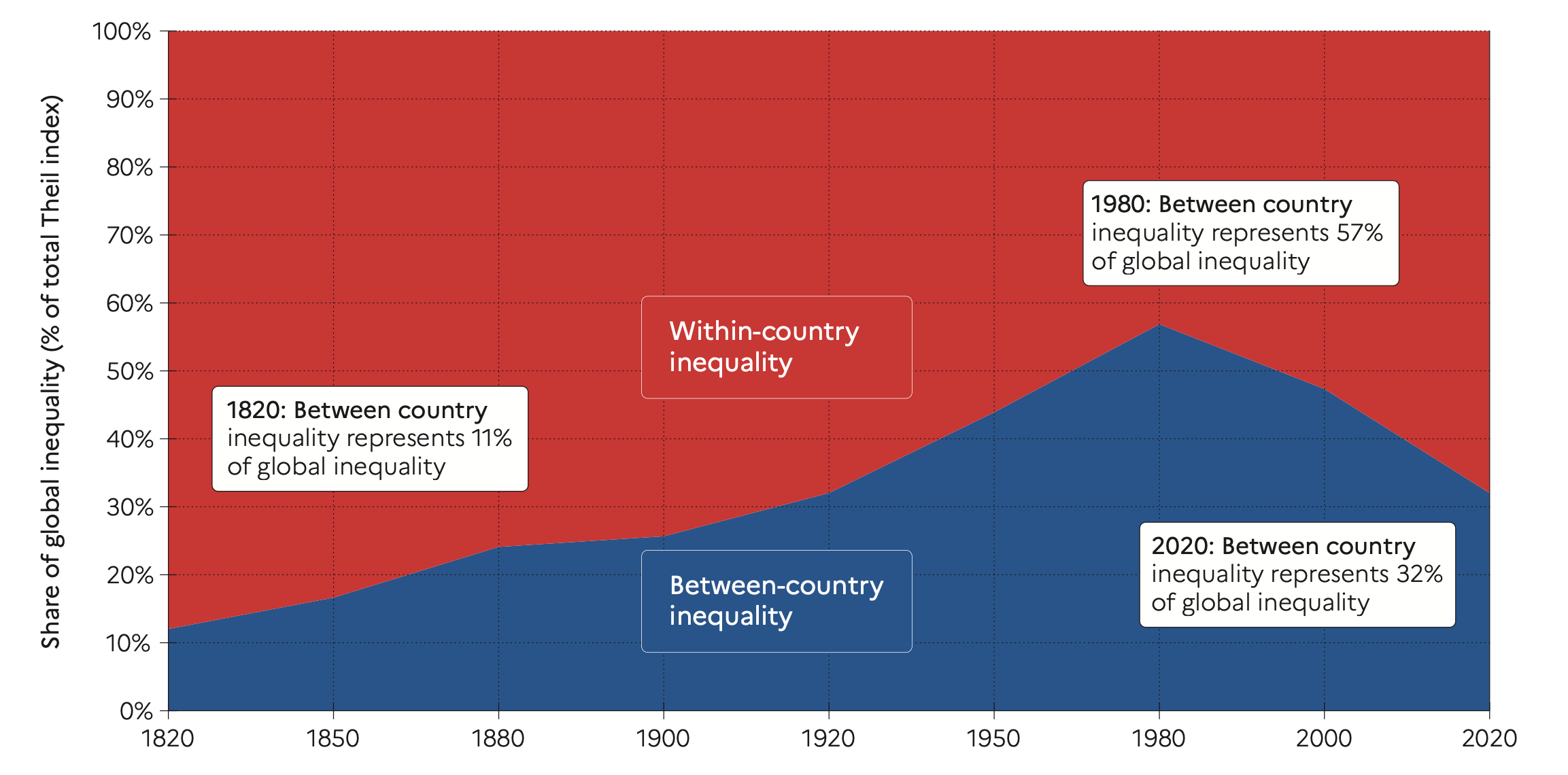

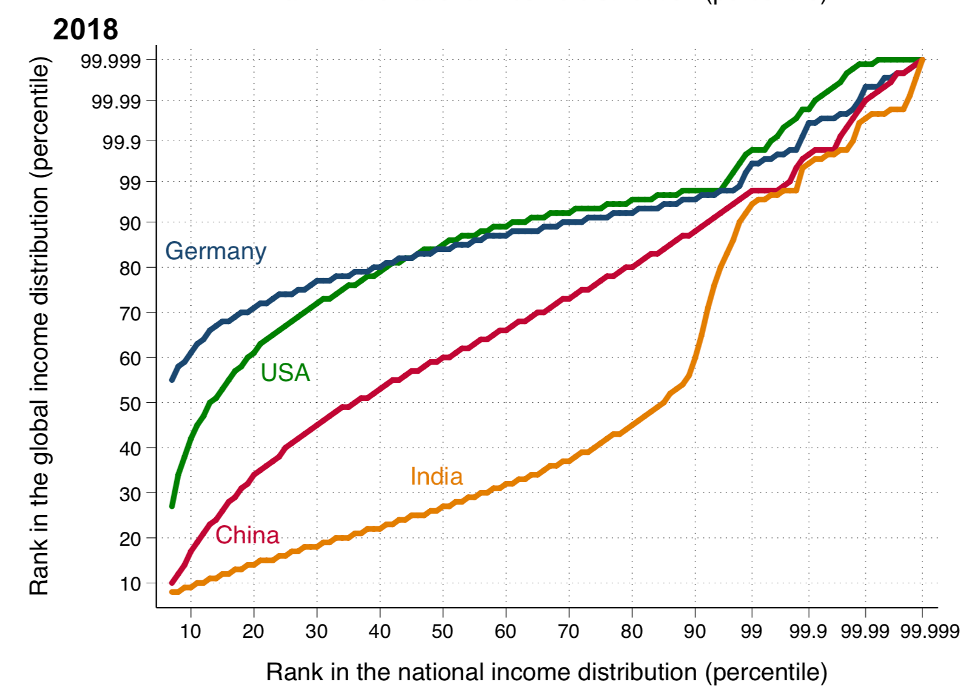

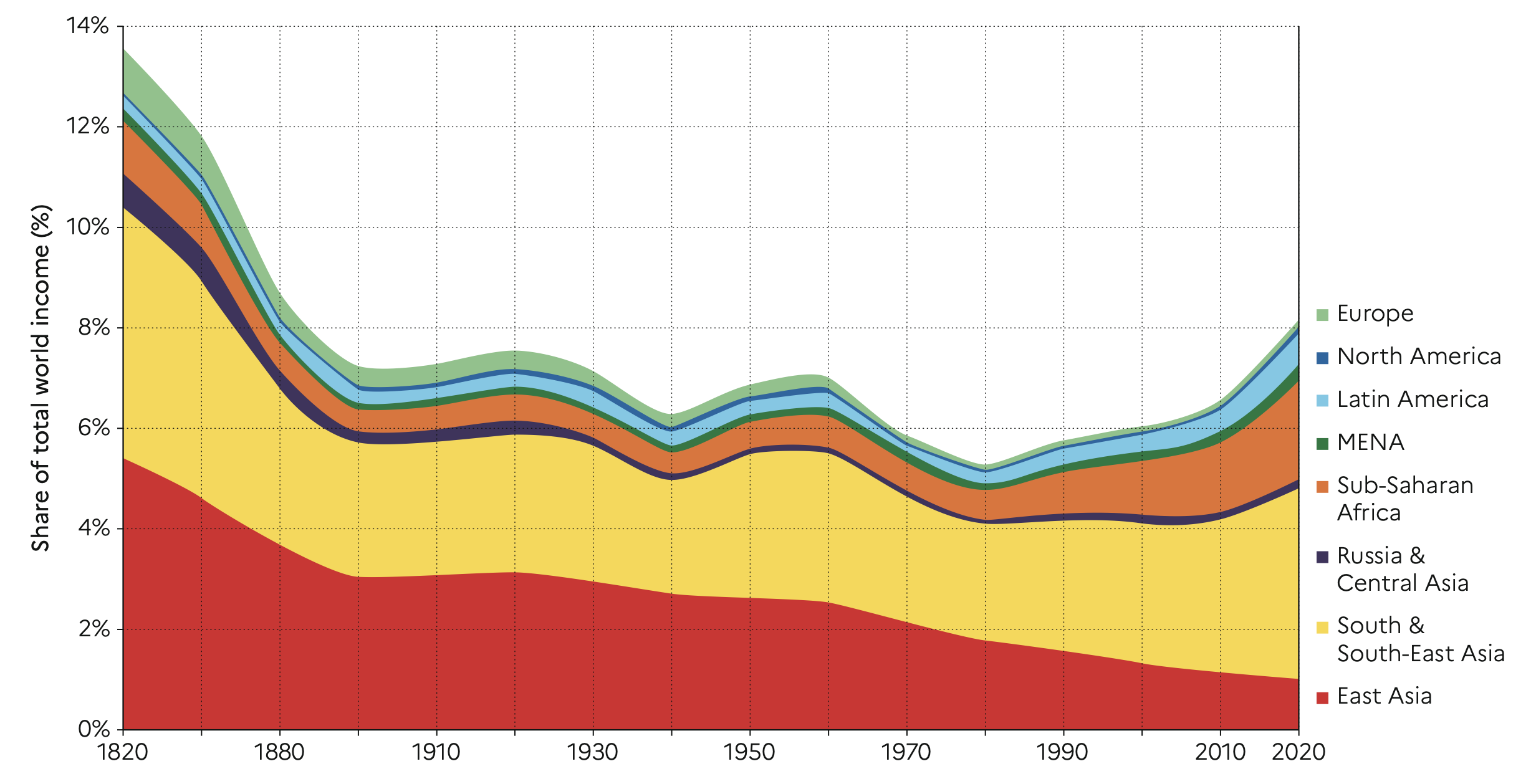

Global inequality 1820-2020

Decomposition of global inequality

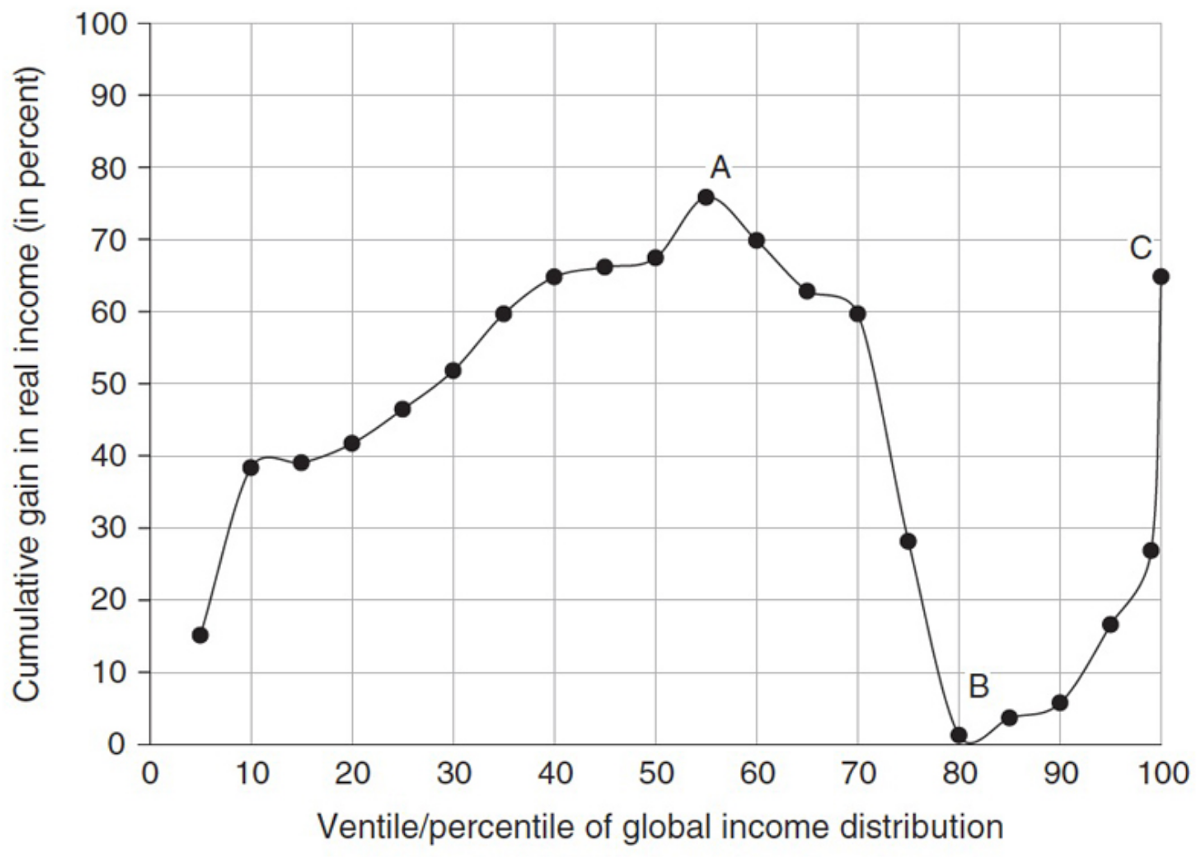

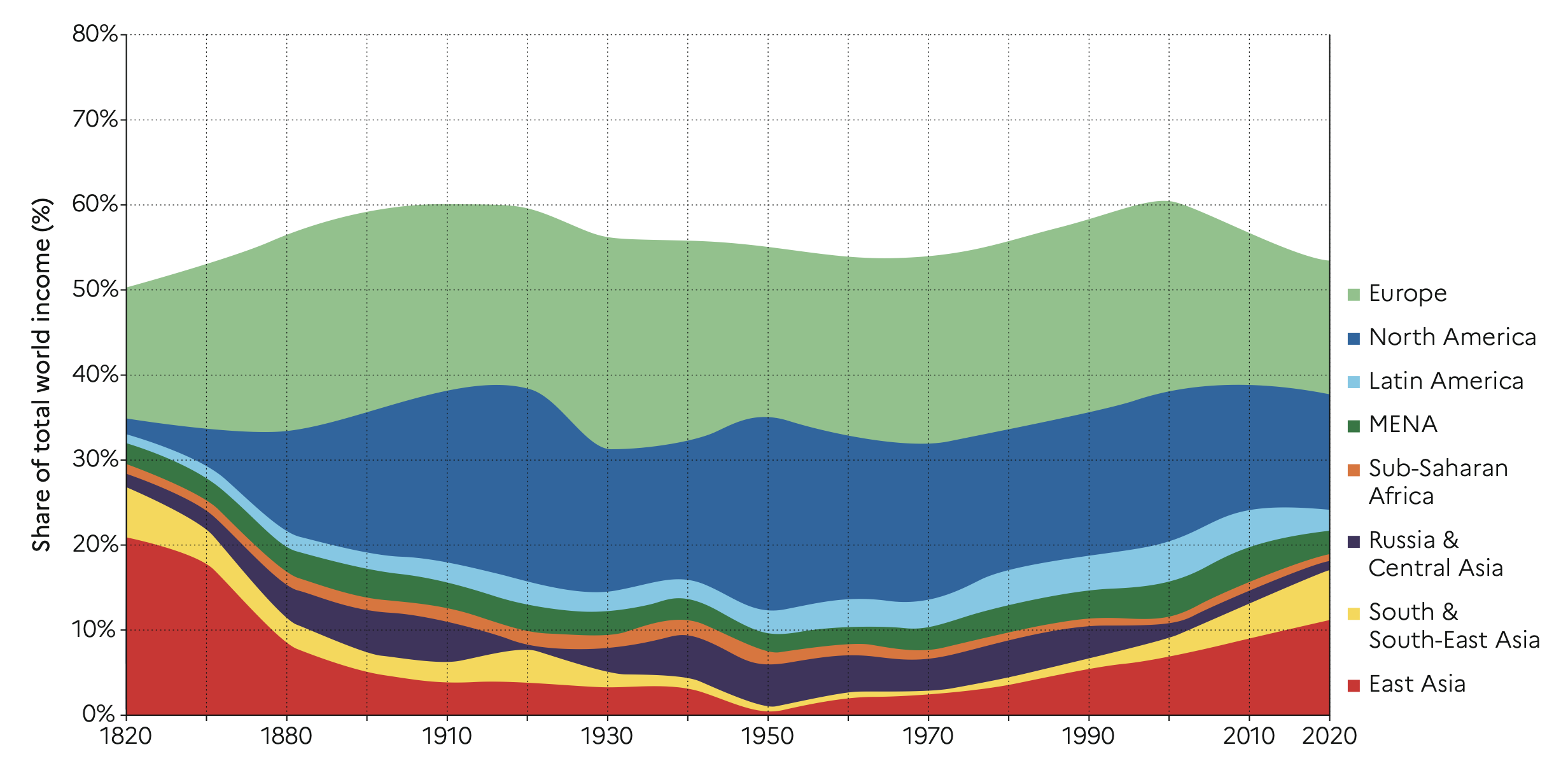

Global growth of real income, 1980-2008

Rising incomes in emerging economies

Stagnation of middle class in industrial countries

Booming global top 1%

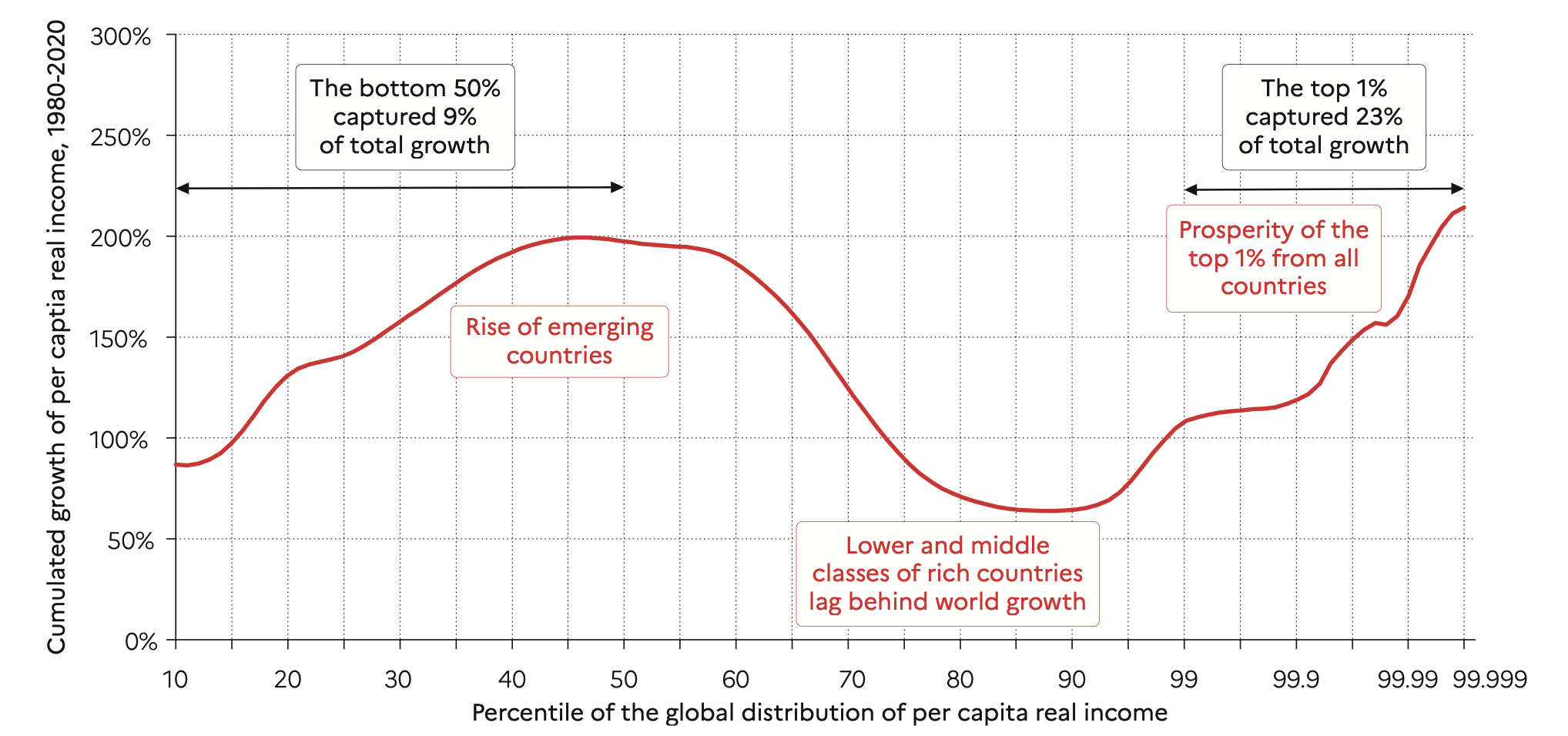

Global growth of real income, 1980-2020

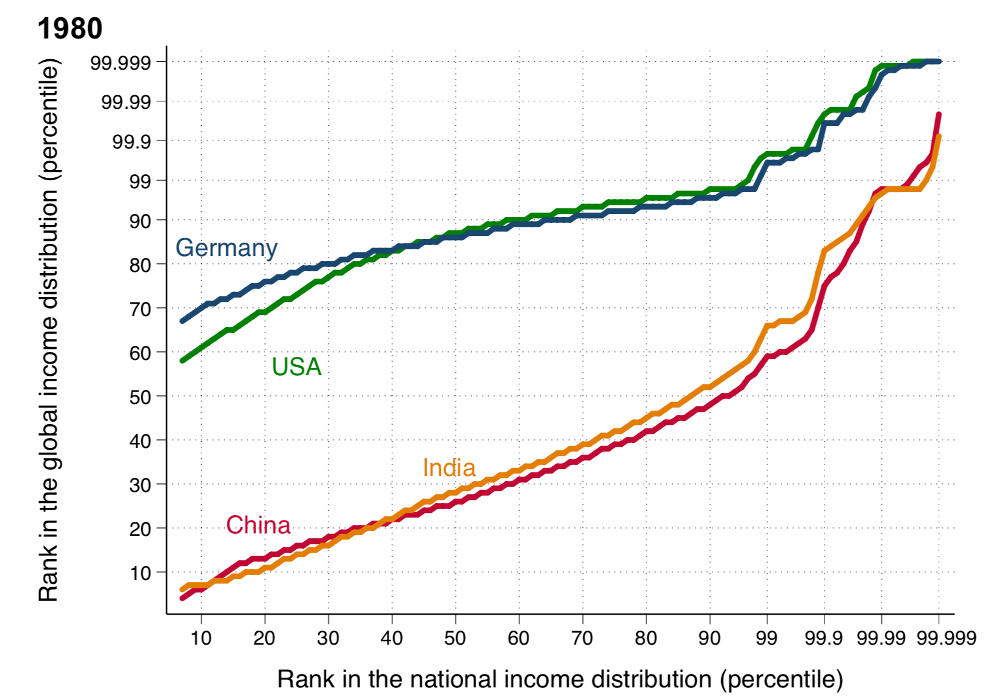

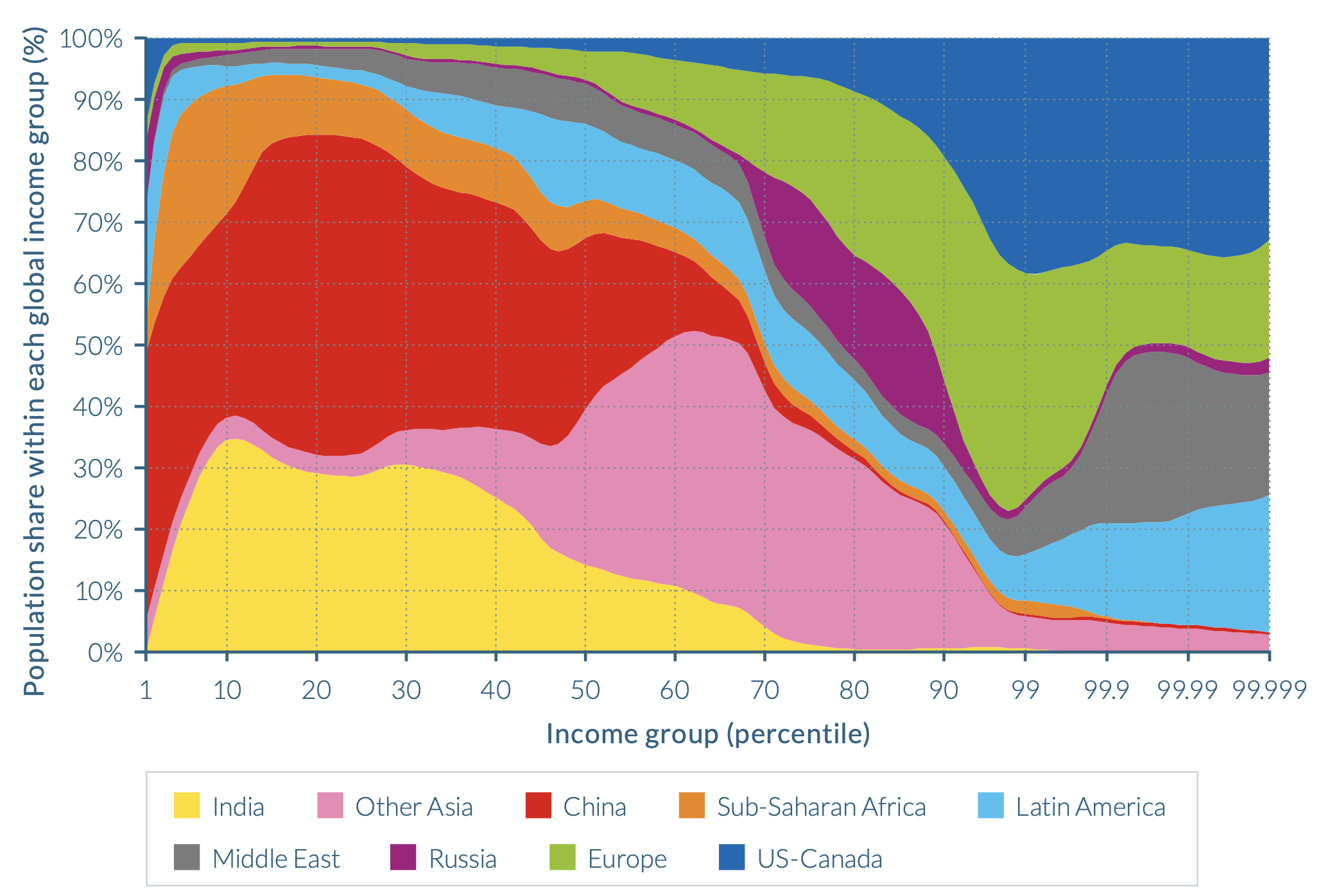

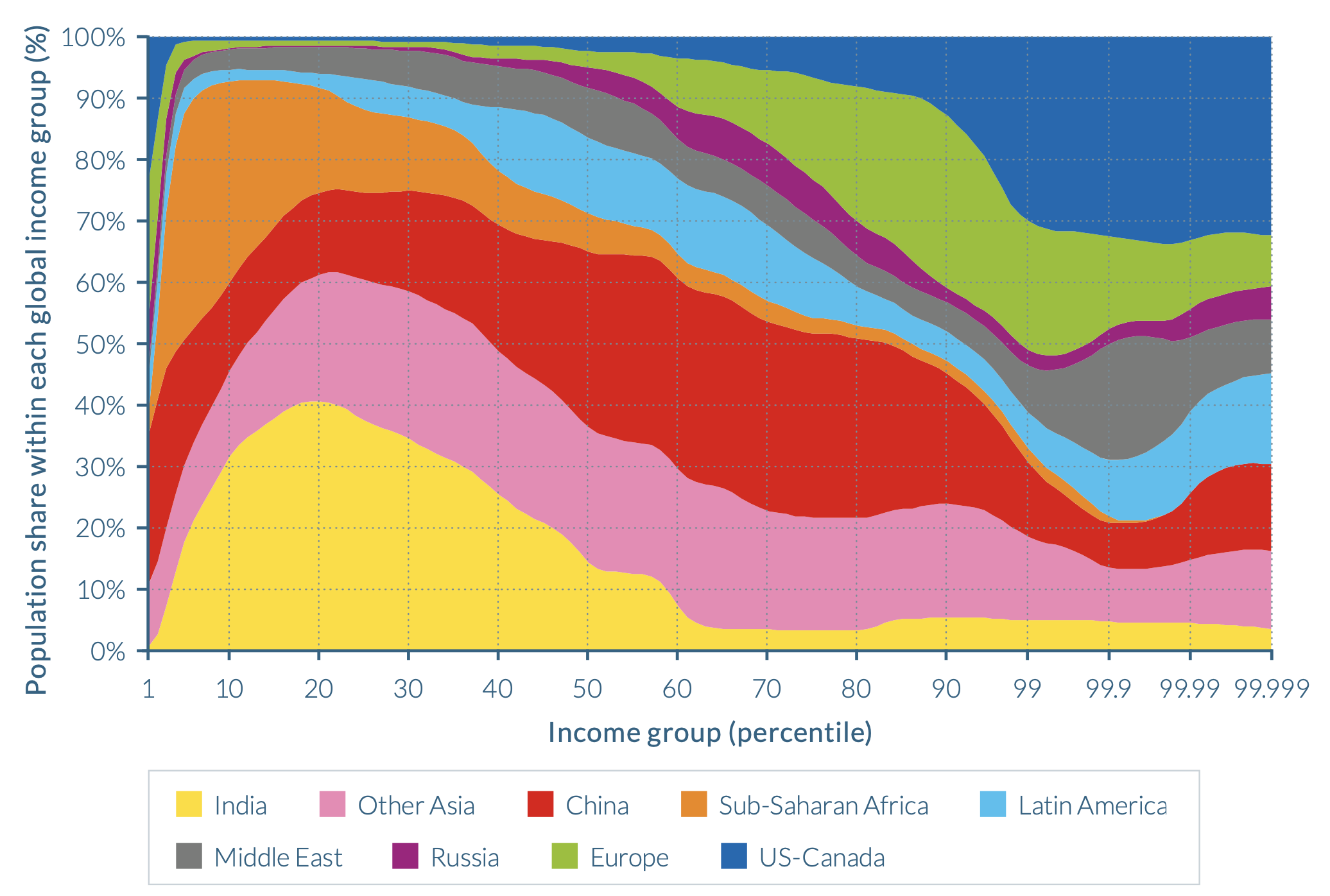

Change in global income distribution

Global income distribution 1990

Global income distribution 2016

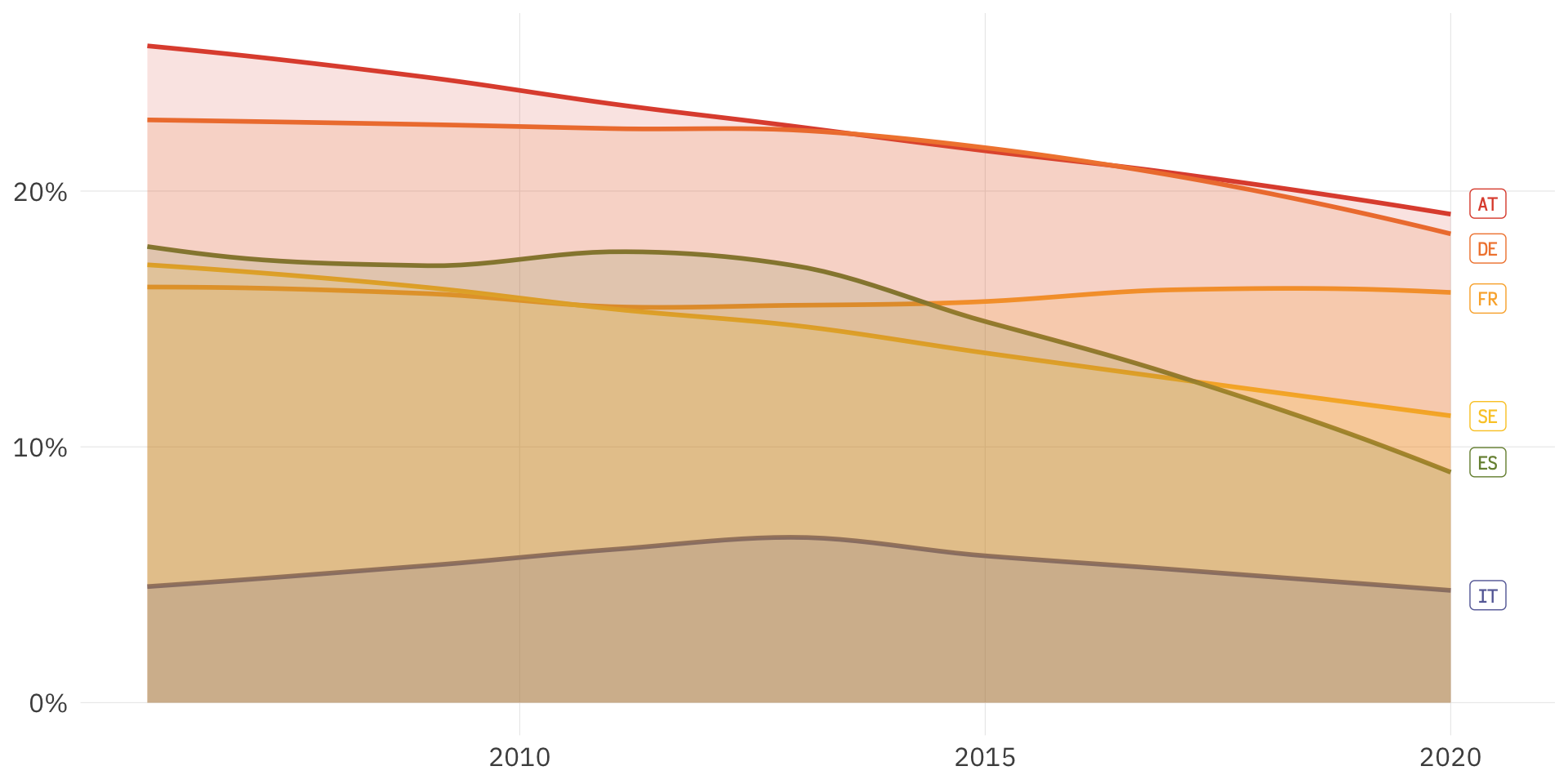

Regional composition of global top 10%

Regional composition of global bottom 50%

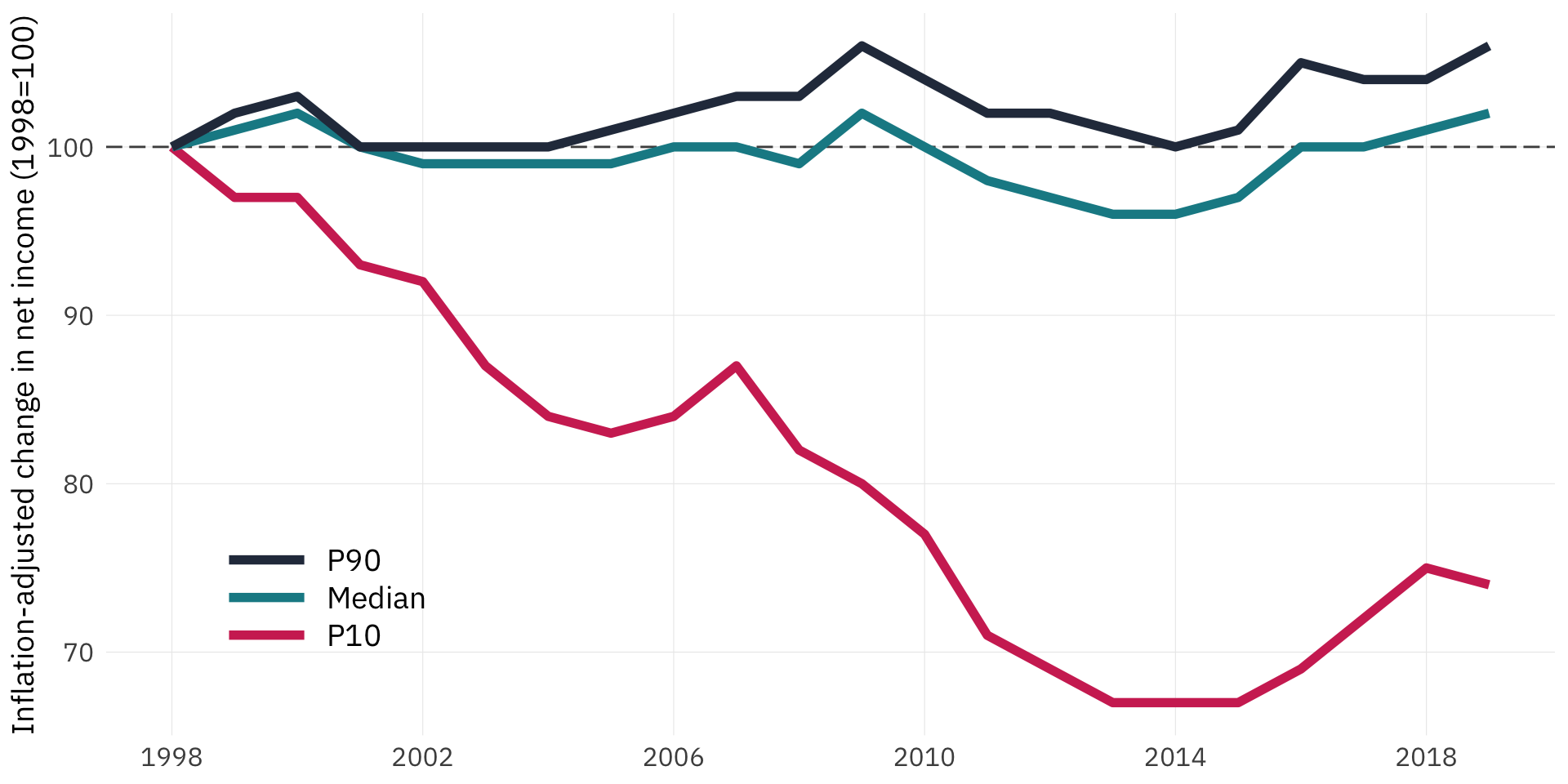

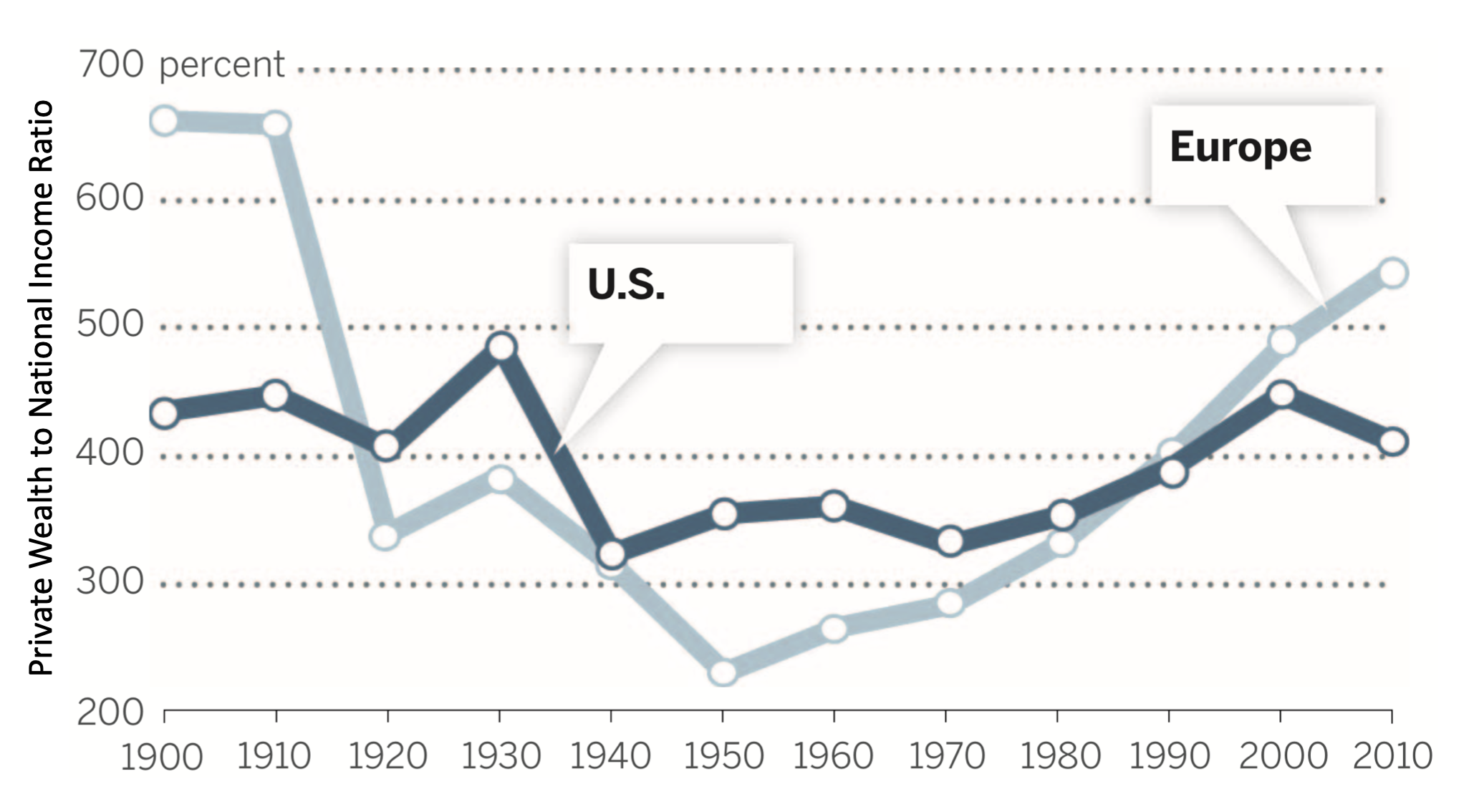

The Piketty argument: Capital is back

![]()

Wealth-to-income ratios

A question of savings rate and growth

\[ \beta = \frac{K}{Y} \approx \frac{s}{g} \]

The ratio of savings rate and economic growth (population + productivity growth) determines the wealth-to-income ratio in the long run.

\(s=10\%; ~g=3\% \rightarrow\) wealth-to-income: \(300\%\)

\(s=10\%; ~g=1.5\% \rightarrow\) wealth-to-income: \(600\%\)

Capital is back because low growth is back!

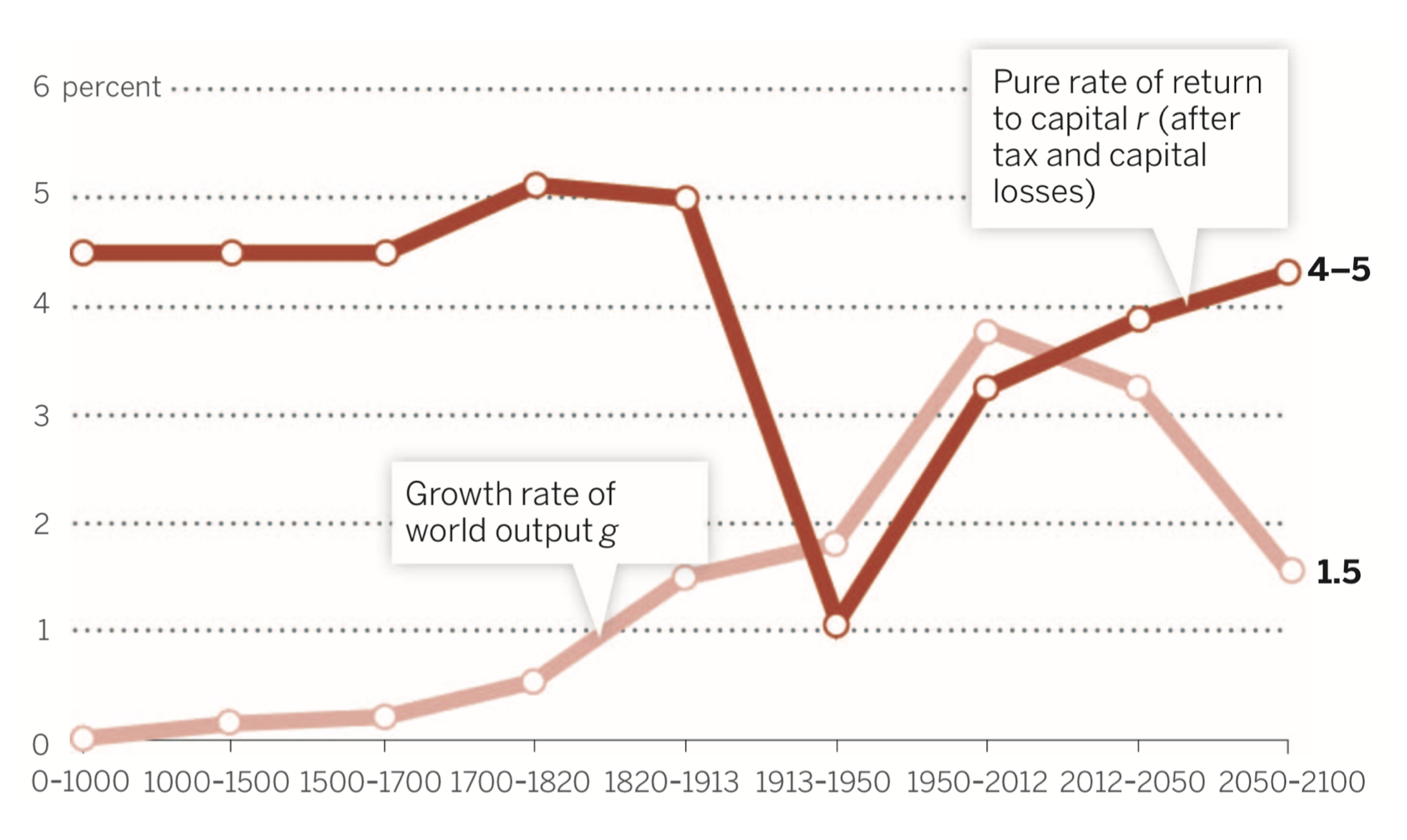

The controversial inequality of \(r\) and \(g\)

Capital share (\(\alpha\)) increases if the rate of return to capital \(r\) is larger than the growth of national income (from work) \(g\): \(r > g\)

\[ \alpha = r\beta = r\left(\frac{s}{g}\right) \]

When the rate of return on capital significantly exceeds the growth of the economy […], then it logically follows that inherited wealth grows faster than output and income. People with inherited wealth need save only a portion of their income from capital to see that capital grow more quickly than the economy as a whole.

Thomas Piketty (2014, 26)

Evolution of \(r\) and \(g\)

Bibliography

PI 2159 Special Topics in Economic Policy | Winter term 2022/23