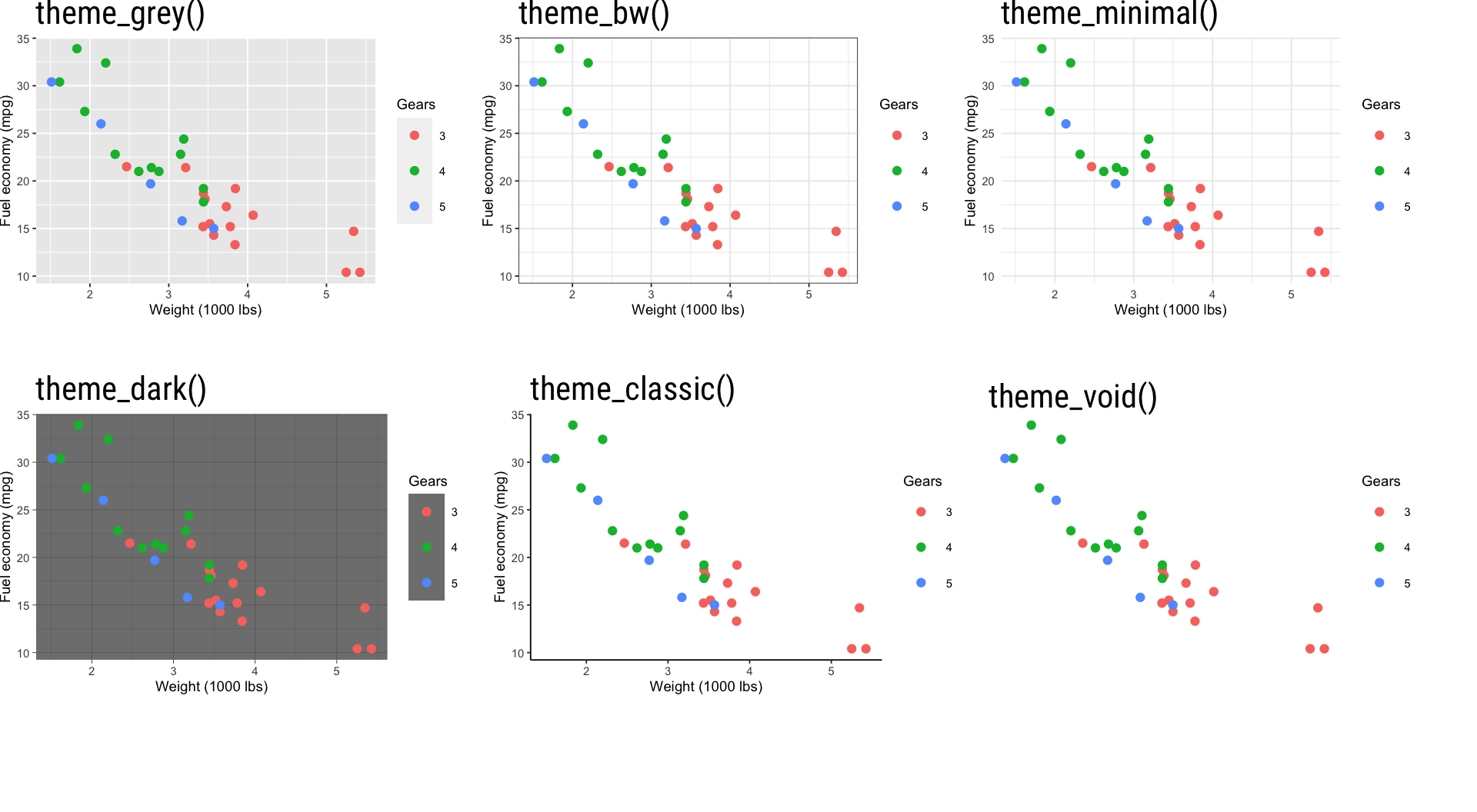

Main theme components

| Plot | Panel | Axis | Legend | Strip |

|---|---|---|---|---|

| background | background | title | background | background |

| title | border | text | key | placement |

| subtitle | grid | ticks | title | text |

| caption | spacing | line | text | |

| margin | position |

Economic Policy Visualization

Wealth · Themes

May 15, 2023

Non-financial assets

Financial assets

Liabilities

No human, social and cultural capital; No public social security pensions (marketable vs. augmented wealth)

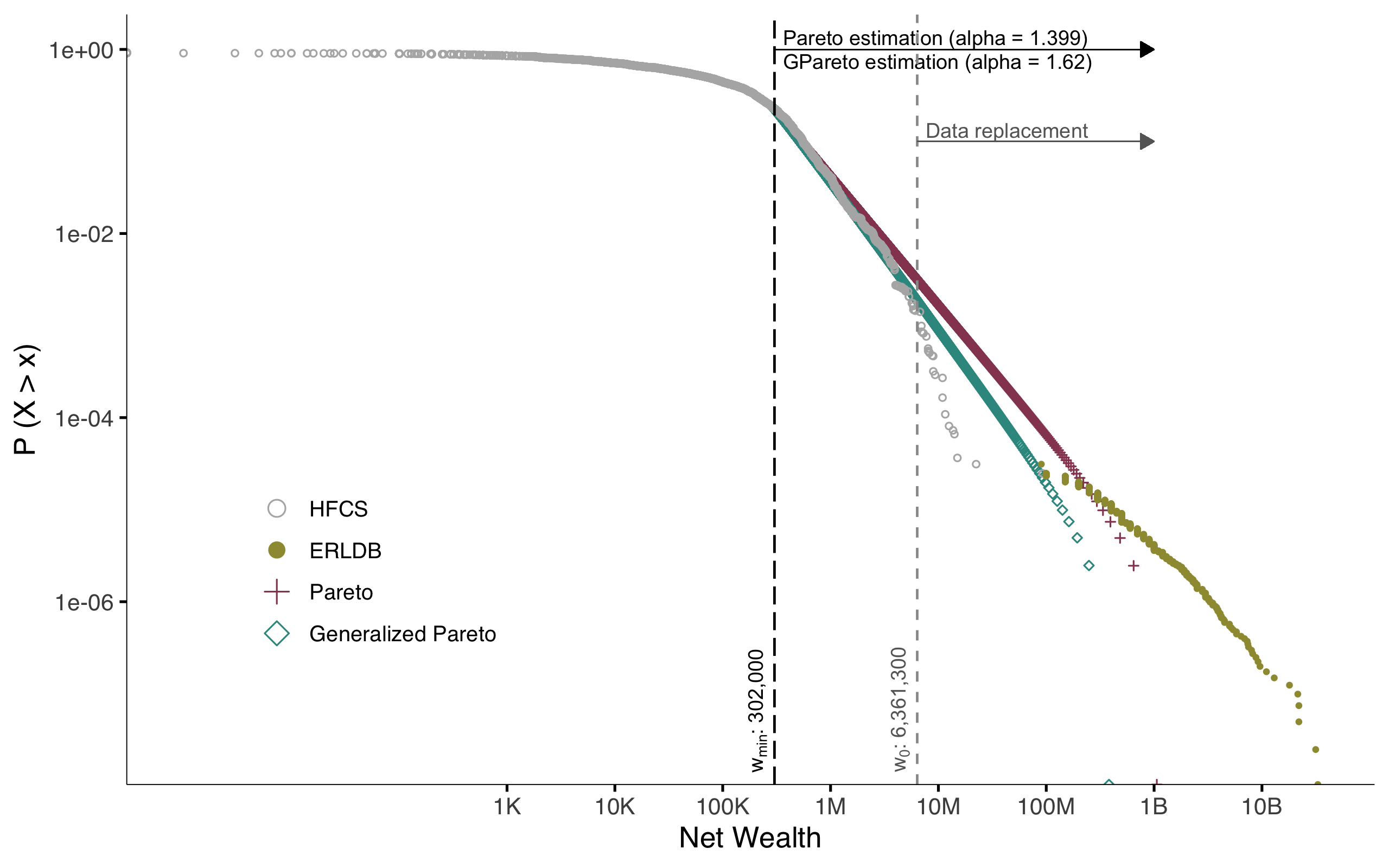

\[P_i(x_i) = Pr(X_i \leqslant x_i) = 1 - \left(\frac{m_i}{x_i}\right)^{\alpha_i}\] \[\forall ~\text{implicates} ~i = 1...5 \wedge x_i \geqslant m_i\]

A smaller \(\alpha\) means greater inequality. Empirically, \(\alpha\) often is around 1.5 for wealth.

| Plot | Panel | Axis | Legend | Strip |

|---|---|---|---|---|

| background | background | title | background | background |

| title | border | text | key | placement |

| subtitle | grid | ticks | title | text |

| caption | spacing | line | text | |

| margin | position |

PI 5620 Advanced Economic Policy | Summer term 2023